Green transformation: summary of objectives and importance of critical minerals

In the last two decades, the global community has started to intensively deal with issues related to environmental protection and mitigation of the effects of climate change. The 2015 Paris Agreement set a target of limiting global warming to significantly below 2 °C, with an aspiration not to exceed 1.5 °C above the pre-industrial average. This target requires a transformation of energy systems, industry and the whole global economy towards low-carbon and sustainable models. The transition to renewable and low-emission energy sources comes with a number of opportunities and challenges. On the one hand, there is potential for other sources of economic growth, job creation and improved quality of life through a healthier environment. On the other hand, this transformation requires significant investment in new technologies and infrastructure, as well as changes in current production and consumption patterns. The article presents the specific targets agreed at the last UN COP28 (Conference of the Parties) meeting in Dubai in 2023 and how they are being met. We then familiarise ourselves with the critical materials that are an essential part of the transition to clean energy. Their regional accumulation and processing increase the risk of their use in geopolitical disputes and endangers the timely transition to a green economy. This vulnerability can be reduced by investments in recycling, which is, however, technologically insufficient and not completely ready for the large number of products that will be disposed of in future decades.

How are we faring?

Greening economies is closely connected to the objective of limiting global warming and better protecting the environment from the impacts of human activity. The 2015 Paris Agreement translated these efforts into specific objectives. One of them is a reduction in greenhouse gas emissions[1] and maintaining a measured average global temperature of up to 1.5 °C above the pre-industrial average (1850–1900)[2]. But why 1.5 °C? Scientists estimate[3] that in the case of an increase of 2 °C:

- Extremely hot days in the mid-latitudes (regions outside the poles and tropics) would be 4 °C warmer on average compared to 3 °C warmer in the case of an overall increase of 1.5 °C.

- The sea level would rise by 0.1 m compared to a temperature rise of 1.5 °C, which would expose up to 10 million people to more frequent flooding.

- 99% of coral reefs would disappear, whereas 70–90% would disappear at 1.5 °C.

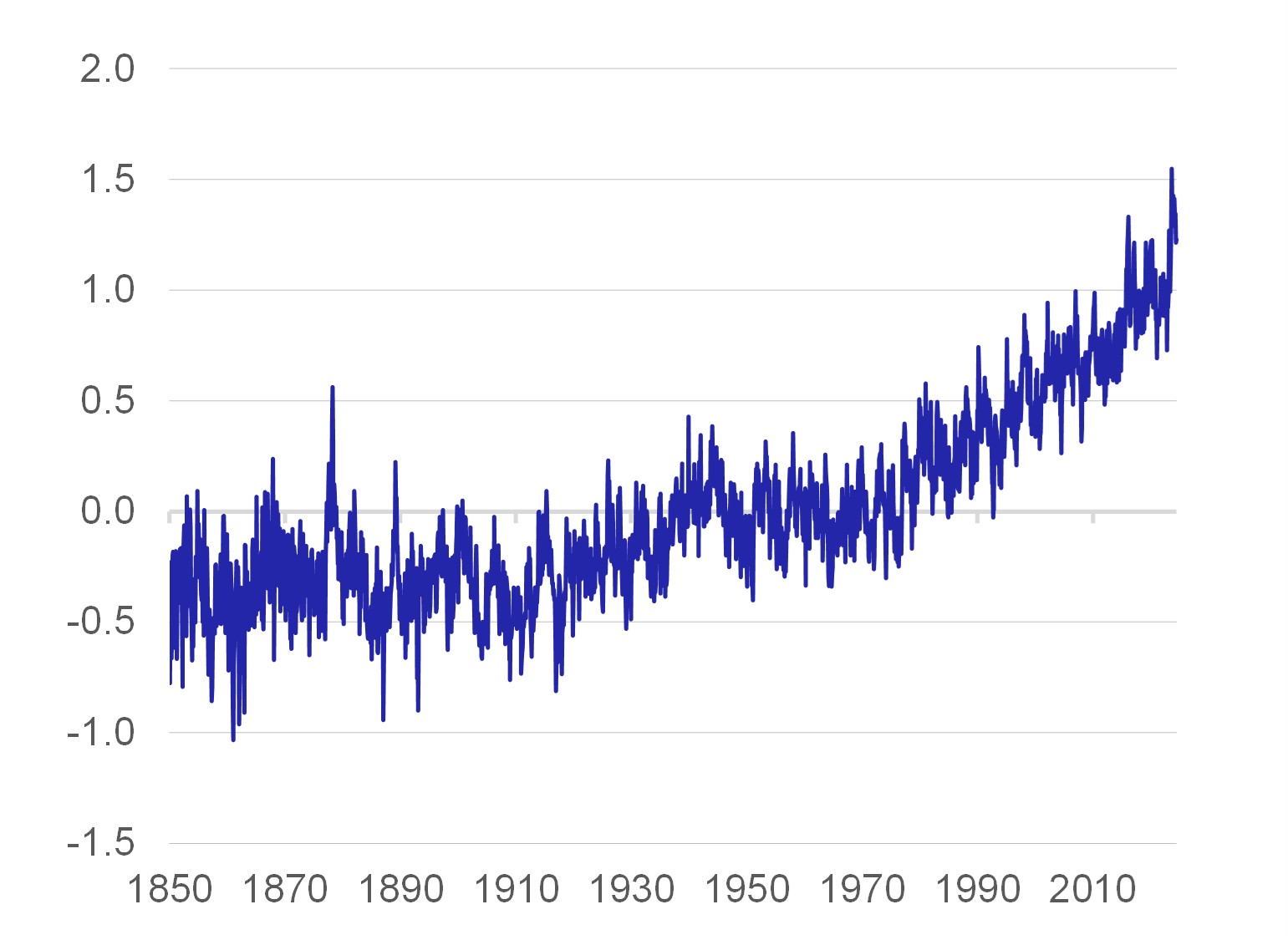

Global warming is clearly getting worse (Chart 1). In 2023, the highest temperature recorded until now is 1.45 ± 0.12 °C above the pre-industrial average. In addition to stopping temperature rises, transitioning to carbon neutrality has other benefits. It represents a great opportunity to transform economies, increase environmental sustainability and improve social welfare. From an economic viewpoint, the transition promises the creation of millions of jobs throughout the world (but more in developed and emerging countries than in developing countries), in particular in renewable energy sectors such as solar and wind power, which are labour-intensive (Fragkos and Paroussos, 2018). By reducing dependence on fossil fuel imports, countries can strengthen their energy security and reduce their vulnerability to geopolitical tensions and interruptions of supply. Investments in renewable energy sources and energy efficiency not only stimulate economic growth through the development of infrastructure and technological innovation, but also reduce long-term energy costs, because renewable source technologies bring cheaper energy than fossil fuels.

Chart 1 – Deviation from average pre-industrial temperatur

(°C)

Source: https://berkeleyearth.org

On the level of the whole of society, transitioning to cleaner energy sources brings significant health benefits, as it reduces the incidence of diseases related to pollution such as asthma, lung cancer and heart disease. This improvement in public health not only improves the quality of life, but also reduces spending on public healthcare. Renewable energy can bring electricity to remote and insufficiently-served areas, promoting energy independence and enabling all communities to use modern energy services. This approach is essential for improving the standard of living and supporting economic growth in such regions. In addition, decentralised renewable energy systems, such as rooftop solar systems, can increase communities’ resilience to climate impacts by providing reliable energy and reducing dependence on centralised energy grids.

From the technology viewpoint, this transition is the driving force behind innovation and enables countries to take a leading position on the global market in clean energy technologies. This leading position attracts additional investments, supports research and development and there is a spillover of innovation into different sectors. Introducing modern and efficient technologies, such as smart grids, energy storage and advanced renewable energy systems, optimises energy use, reduces losses and increases the overall efficiency and reliability of energy systems.

The topic of greening economies is broad and includes a number of areas such as the decarbonising of industry, the circular economy and water management. In this article, we will primarily focus on the critical (crucial) minerals for production for the transition to carbon neutrality and related recycling.

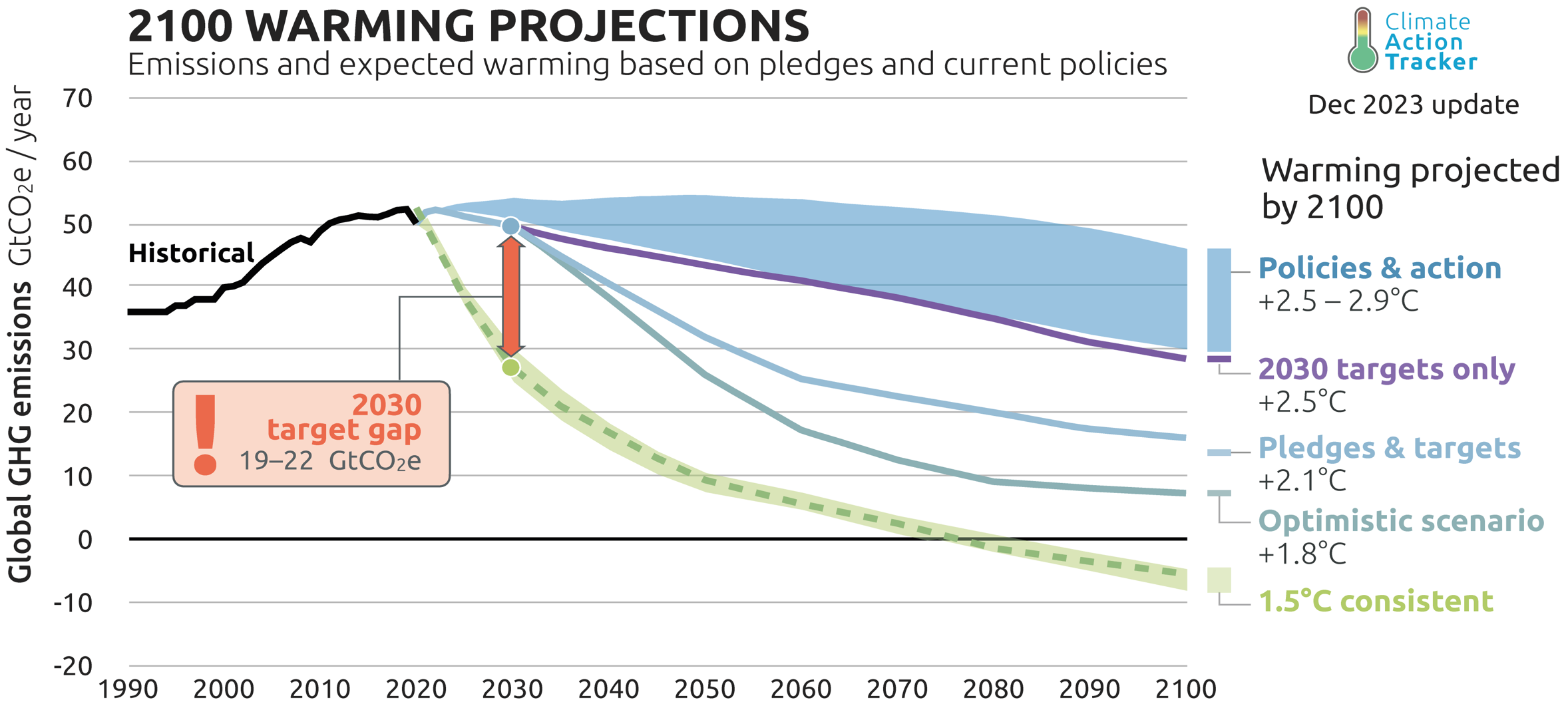

According to Climate Analytics and the NewClimate Institute, which created the Climate Action Tracker (CAT), countries’ current policies are far from consistent with the objective of the Paris Agreement (Chart 2). In the case of the optimistic scenario, which includes all binding and notified objectives, we will reach 1.8 °C (0.3 °C above the target) in the long term. If we project the current state of implementation of policies, emissions would remain stable for several decades and then start to decline slightly at a temperature of +2.5 to +2.9 °C. Current efforts are therefore insufficient. The UN International Panel for Climate Change (IPCC UN) is of a similar opinion[4]. In the next year, participating countries have to submit revised non-binding national plans (“nationally determined contributions”) for 2030 and new objectives for 2035.

At COP28 in Dubai, a number of targets were agreed to achieve reductions in greenhouse gas emissions. Some specific targets related to energy are monitored and assessed by the International Energy Agency (IEA) in cooperation with other institutions. The following box 1 offers a brief overview of these.

Chart 2 – Projections for Growth in Greenhouse Gas Emissions and Their Impact on Warming

Source: Climate Action Tracker

The world is falling behind the Paris Agreement targets and governments are preparing for COP29 in Baku, where they will present revised nationally determined contributions (NDCs) to reduce emissions after 4 years. It is evident that all regions have to markedly increase their efforts and prepare more ambitious targets across a number of sectors in order to achieve the emissions targets.

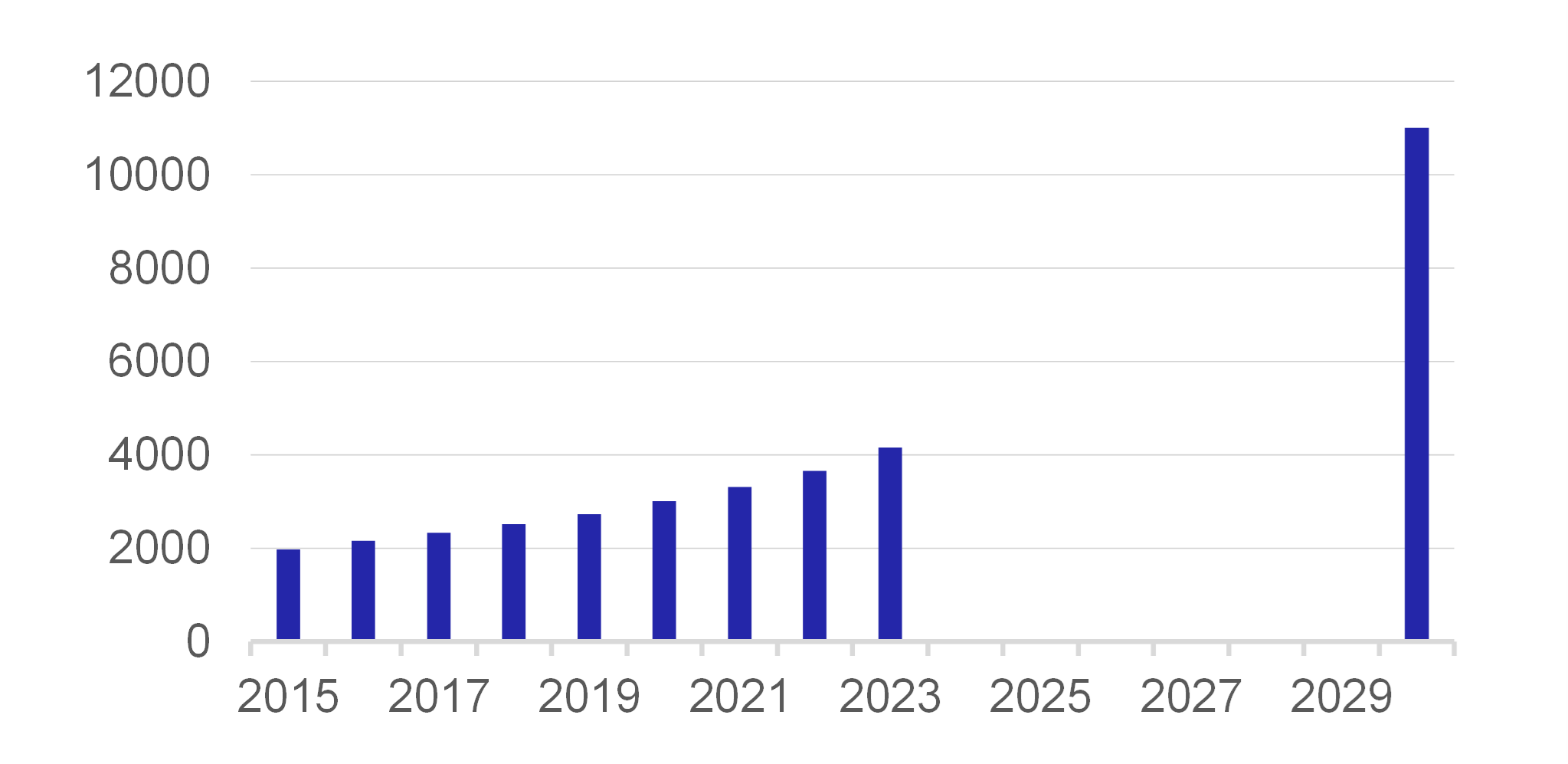

Chart 3 – Global Production of Electricity from Renewable Sources

(GWh)

Source: https://www.iea.org

Electricity production saw marked growth in 2023 thanks to photovoltaics and wind energy. China, together with Europe and the USA, are investing the most in this segment

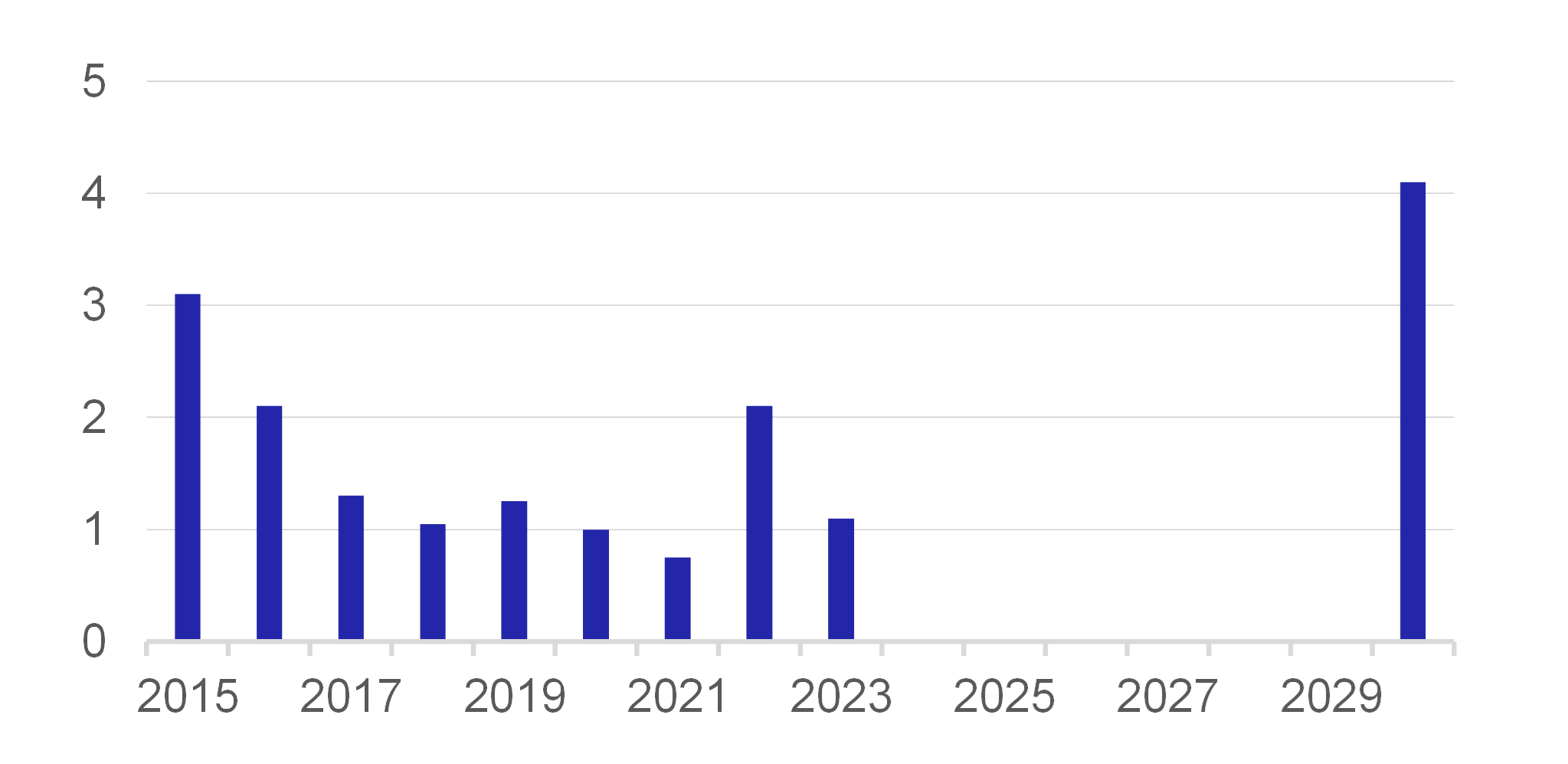

Chart 4 – Growth in Energy Efficiency

(units)

Source: https://www.iea.org

Note: Measured as primary energy demand, or rather reductions in it..

In order to achieve zero emissions of greenhouse gases, it is necessary to improve energy efficiency to 4% a year.

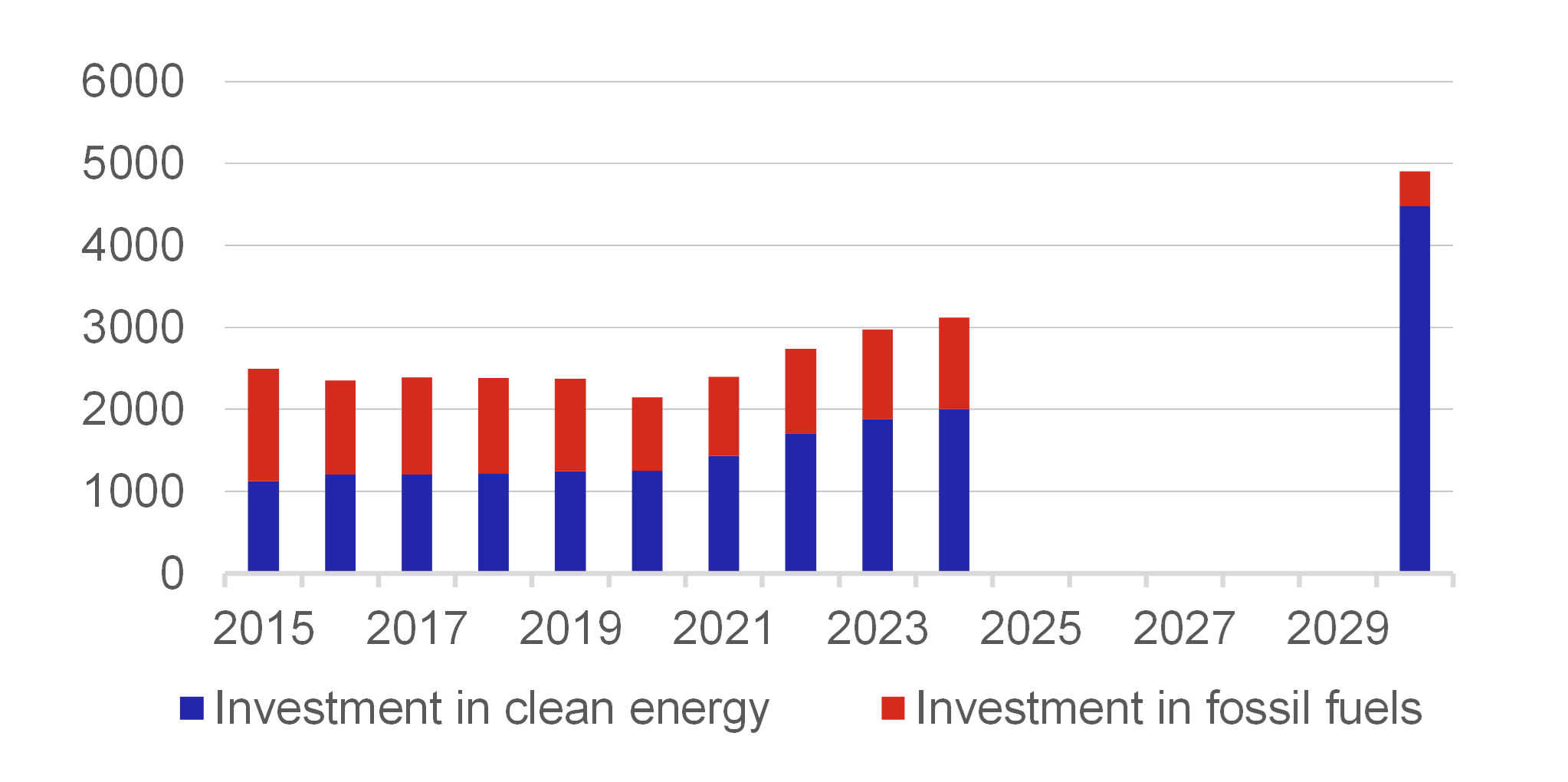

Chart 5 – Global Production of Electricity from Coal

(TWh)

Source: https://www.iea.org

Electricity produced from coal is the largest individual source of CO2 emissions. In line with current measures, it is expected that demand for coal will reach a peak before the end of this decade and will then gradually decline, which is not consistent with the COP28 target.

Chart 6 – Global Emissions from the Energy Sector

(Gt CO2)

Source: https://www.iea.org

Another target from COP28 is a marked reduction in energy sector emissions by 2030 and zero emissions by 2050. These emissions, however, still rose to record levels in 2023, in particular because of the lower contribution of hydropower due to drought.

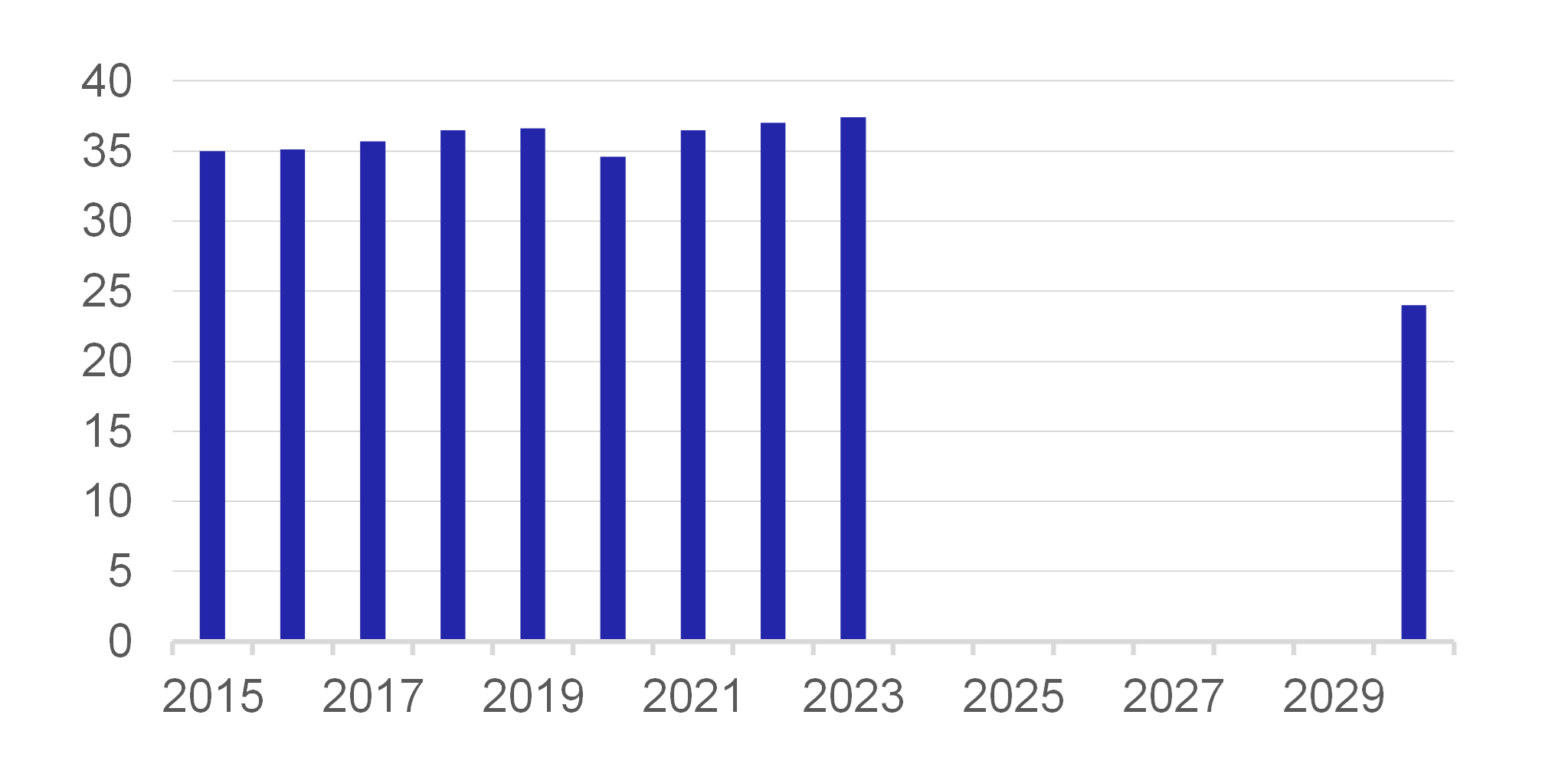

Chart 7 – Global Demand for Fossil Fuels

(EJ)

Source: https://www.iea.org

On the path to zero emissions by 2050, demand for fossil fuels must fall by more than a quarter from the 2023 level by the end of the decade. This is another target that is not being achieved.

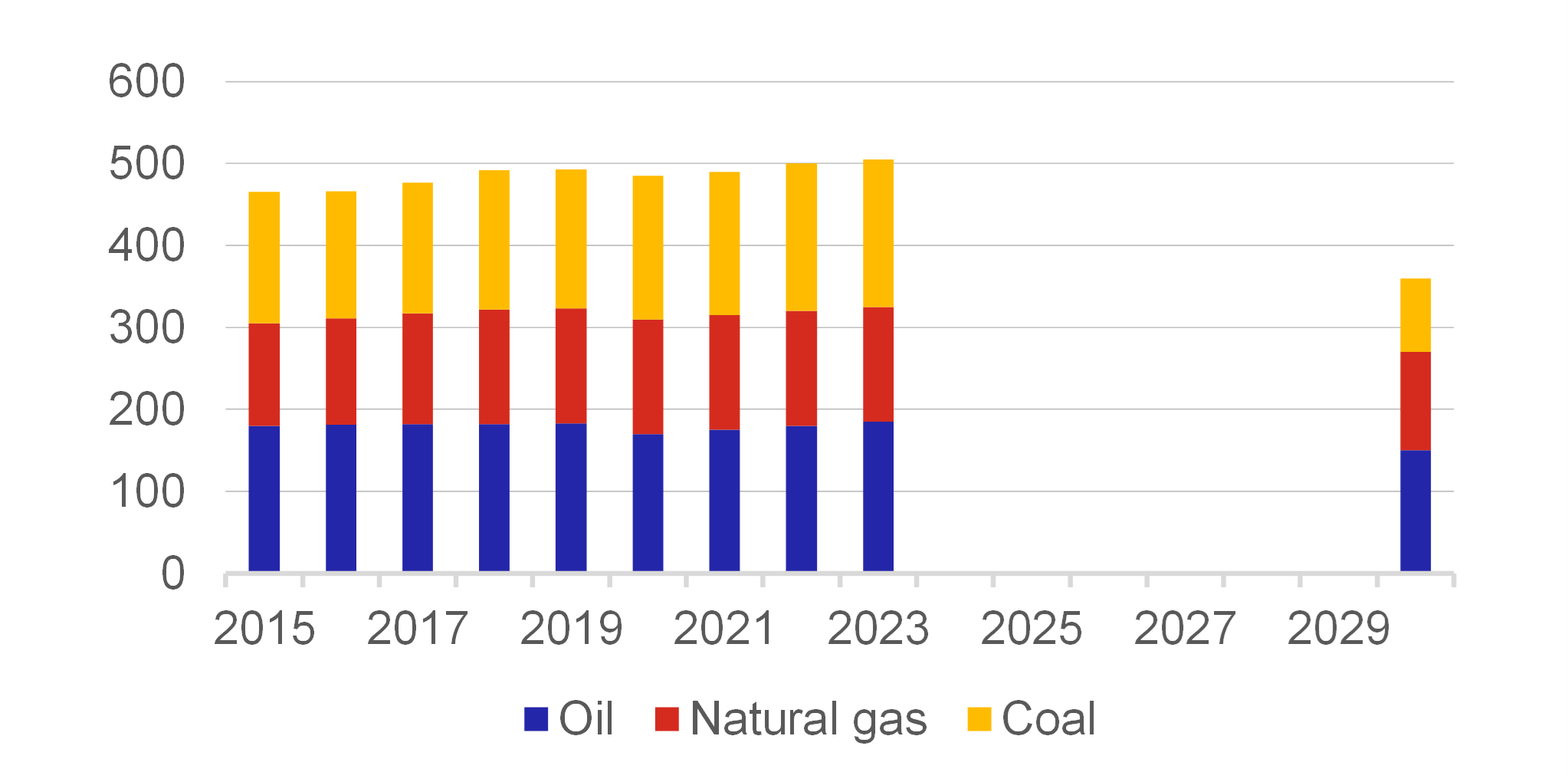

Chart 8 – Global Investments in Clean Energy and Fossil Fuel

(bil. USD)

Source: https://www.iea.org

At the current time, investments in clean energy in developing and emerging economies outside China are insufficient. Even in the case of zero emissions there is still a need for certain investments in the current oil and natural gas infrastructure.

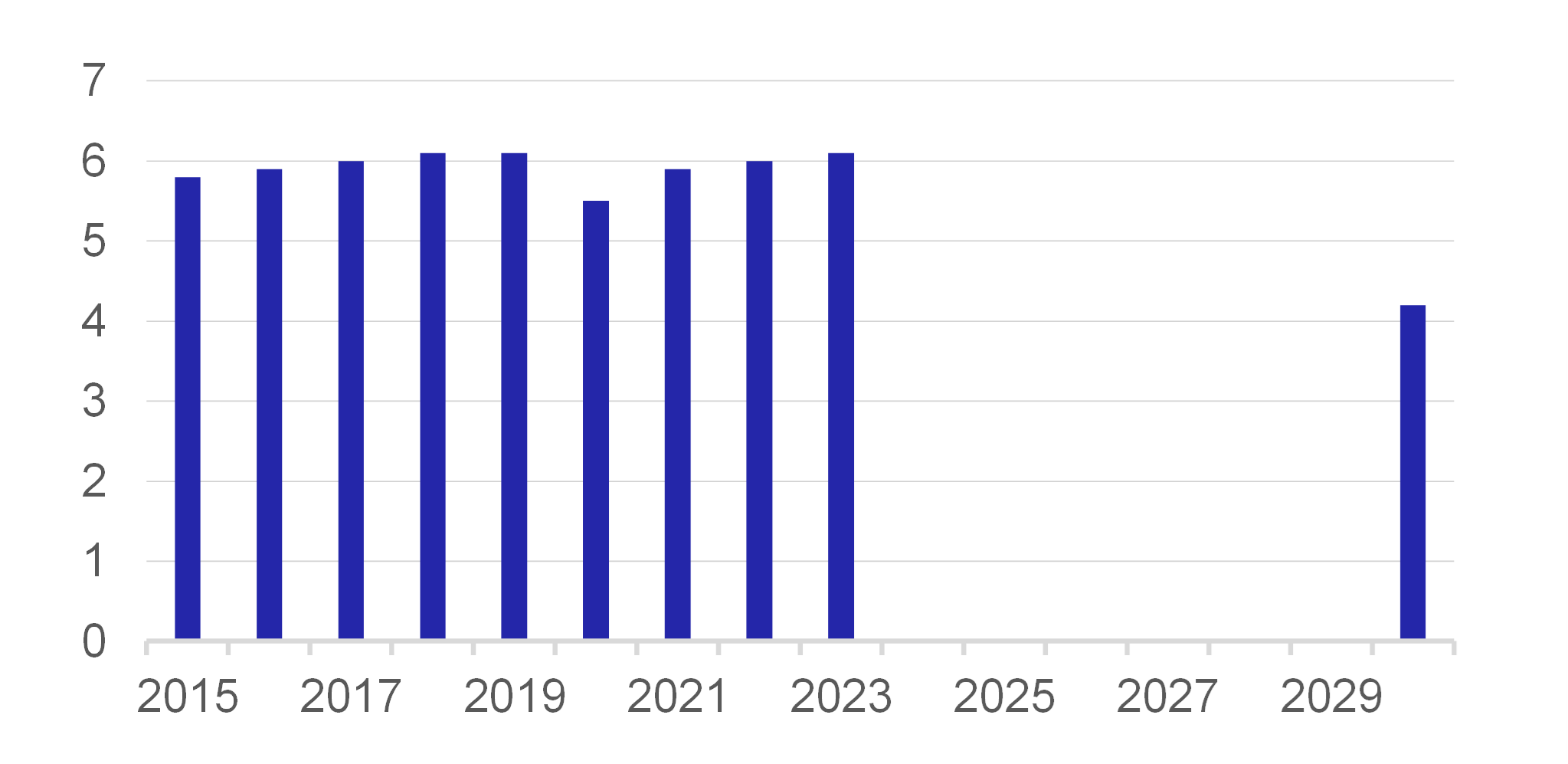

Chart 9 – Global Emissions of Methane from Fossil Fuels

(Mton)

Source: https://www.iea.org

In addition to carbon dioxide emissions, one of the goals is to reduce methane emissions from fossil fuels. Such emissions are responsible for approximately 30% of the increase in global temperatures since the industrial revolution.

Chart 10 – Global Emissions from Road Transport

(Gt CO2)

Source: https://www.iea.org

Rapid reductions in emissions from road transport, including infrastructure development, are another objective from COP28. If growth in the number of electric vehicles continues at the same rate, this would be more than sufficient to achieve the desired emissions reductions.

Critical (Crucial) Minerals

Definitions of critical minerals differ by region, geopolitical and economic factors.[5] But we are interested in the raw materials needed to produce products for the transition to a green economy. They are products such as batteries, wind turbines and electrolysers.

According to the IEA, demand for critical minerals rose significantly in 2023, driven by the accelerating transition to clean energy technology. Demand for lithium rose by 30%, whereas demand for nickel, cobalt, graphite and rare earths increased by between 8% and 15%. Electric vehicles strengthened their position as the largest consumer of lithium and markedly increased demand for nickel, cobalt and graphite. Despite the strong demand, marked increases in deliveries and sufficient stocks led to a fall in mineral prices (Chart 11). New sources of deliveries, in particular from Africa, Indonesia and China, have exceeded the growth in demand over the last two years. This, together with surplus stocks in sectors such as batteries and cathodes, as well as a correction to the sharp price increases in 2021–2022 led to pressure for a fall in prices. Sales of electric vehicles totalled almost 14 million in 2023, which represents a year-on-year increase by 35%. Continuing growth in sales of electric vehicles on the main markets is expected, although adoption in developing economies will rise. In the scenario for achieving zero emissions by 2050, the share of sales of electric vehicles rises from the current 18% to 65% in 2030, which means that demand for batteries will increase seven-fold to 6 TWh in 2030.s

Chart 11 – Trends in prices of critical material

(index, 100 = January 2020)

Source: Global Critical Minerals Outlook 2024, IEA

According to the IEA stated policies scenario (STEPS),[6] it is expected that demand for minerals for clean energy technology will double by 2030. The announced pledges scenario (APS)[7] forecasts even higher demand, which will almost treble by 2030. Lithium can expect the fastest growth in demand because of growing needs for batteries for electric vehicles, whereas copper, which is key for an electrified energy system, is seeing the greatest increases in production volume. According to the NZE scenario (“Net Zero Emissions”), demand for graphite will almost quadruple by 2040, whereas the demand for nickel, cobalt and rare earths will double.

Some countries from various regions will benefit from expansion of the market in critical materials. Latin America should obtain by 2030 the highest market value for unextracted production, approximately USD 120 bn. Indonesia, driven by its nickel production, is expected to double its market value, while Africa will see a 65% increase. By 2030, it is expected that China will concentrate almost 50% of the market value from refining. Concentration in the mining sector looks different when examined from the viewpoint of asset ownership (Chart 12), with US and European companies playing a major role in supplying copper and lithium, whereas Chinese companies play a larger role in nickel and cobalt production, although these minerals are mined elsewhere (for example, in Indonesia for nickel and in the Democratic Republic of Congo for cobalt). Despite the smaller growth in 2023 in comparison with 2022, investment in the mining of critical minerals rose by 10%. China, in particular, is active in this segment.

Chart 12 – Ownership and geographic structure of extraction

(%)

Source: Global Critical Minerals Outlook 2024, IEA

Despite the increase in mining capacities, according to IEA estimates there is a very large gap between expected supplies and demand for copper and lithium, where expected supplies from announced projects cover only 70% of the demand for copper and 50% of the demand for lithium. Supplies of nickel and cobalt better reflect the needs of demand, provided expected projects are completed on time. Nevertheless, graphite and rare earths face the risks of a concentration of supply, where more than 90% of the graphite for batteries and 77% of refined rare earths will come from China by 2030. Similarly, 70%–75% of the increase in production of refined lithium, nickel, cobalt and rare earths by 2030 will come from today’s largest 3 producers. The 5 largest mining companies control 61% of lithium mining and 56% of cobalt mining. Limited progress in the diversification of supply and the high concentration of production in a few countries are risks for the energy transformation.

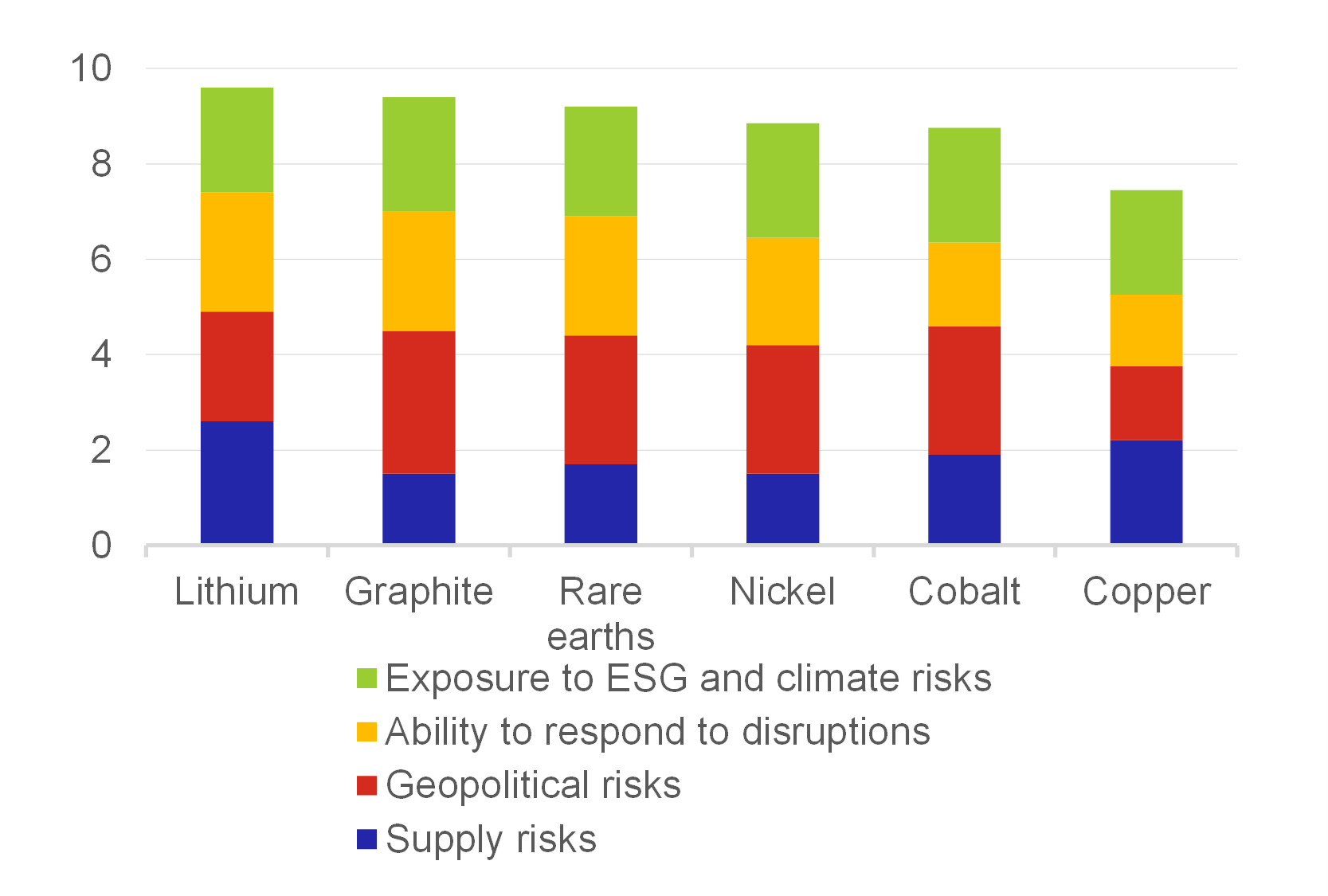

The current falls in prices, although they are beneficial for the deployment of clean energy, are preventing investments in critical minerals and their diversification. A comprehensive risk assessment by the IEA reveals the potential vulnerability of each mineral when supporting the aims of the energy transformation (Chart 13)[8]. Lithium and graphite have the highest risk score, where the risk for supplies and volume are especially high for lithium and copper, and the geopolitical risk is significant for graphite, cobalt, rare earths and nickel. High environmental risks are also a cause for concern, in particular in regions relying on coal for refining. The search for critical materials could bring about geopolitical competition in areas with significant deposits, such as the Arctic or greater depths of the ocean. Even if stocks are more than adequate, caution is needed given the environmental impacts and regulatory challenges of exploiting underground and deep-sea resources. Any suspension of deliveries of critical materials has different implications to those in the case of fossil fuels. After being built, renewable sources work for decades, even if the supply of inputs is suspended. There is no interruption of energy security, as is the case for fossil fuels. The negative impact is only the slowdown in the energy transition process.

Chart 13 – Developments in the volume of world trade

(units)

Source: Global Critical Minerals Outlook 2024, IEA

Dealing with the challenges of supply concentration and investments in critical minerals requires targeted political intervention. Increasing the transparency of the market through effective mechanisms for determining prices and financial tools to ensure risks can support investments. An increase in the availability of reliable data about consumption, supplies and trading is also essential. In addition to this, politicians that support recycling, innovation in alternative chemistry and the correct sizing of batteries for electric vehicles can help mitigate future pressure on supply and support sustainable development in supply chains.

Recycling

Recycling may not eliminate the need for additional primary supplies, but it offers significant potential as a secondary source of critical minerals, in particular because large volumes of batteries and other end-of-life products will be available in the coming years.

The recycling of materials used in green technologies represents a marked challenge with regard to the complexity of the relevant products. Batteries for electric vehicles, solar panels and wind turbines are often made up of a complicated mixtures of metals, plastics and composite materials. For example, lithium-ion batteries in electric vehicles contain not only lithium, but also cobalt, nickel, manganese and graphite, which are built in to complicated structures. Similarly, solar panels contain silicon wafers, silver and aluminium, often covered with protective layers and glass. Wind turbine blades are produced from durable composite materials that are designed to withstand harsh weather conditions. The complicated combination of these materials makes it hard to separate and recover the individual elements during the recycling process, which frequently requires advanced and specialised techniques.

The current state of the recycling infrastructure is not fully equipped to handle the high demands on such materials. Because traditional recycling equipment is optimised for simpler materials such as paper, glass and standard metals, it cannot cope with the more sophisticated materials found in green technologies. Many recycling plants lack the tools for the effective disassembly of complicated products or for processing specific materials. This limitation leads to a subsequent lower degree of use of critical/valuable materials and they are often left unprocessed or recycled into products with a lower value. In addition, the capacity of the current recycling infrastructure is often not sufficient to deal with the growing volume of materials coming into being as a consequence of the transition to environmentally-friendly technologies. From the economic viewpoint, material recycling faces several challenges. The main problem is the cost-effectiveness of recycling, because the processes necessary to separate and obtain valuable materials from complicated products are often expensive and energy-intensive. In addition, the demand for recycled materials on the market can be volatile, as fluctuations in prices of primary materials sometimes make recycling less financially attractive. Logistical problems also play an important role; collecting and transporting used products to recycling facilities can be costly and complicated, especially for large or dangerous items such as batteries for electric vehicles or wind turbine blades.

The recycling and correct sizing of batteries for electric vehicles could significantly reduce future demand for minerals. For example, according to the IEA (IEA, 2024b), by 2024 recycling could reduce the primary need for copper and cobalt by 30% and for lithium and nickel by 10% by 2040. Without an increase in the recycling and recovery rate, the capital requirements for mining would have to be a third higher. Innovations, in particular in battery composition chemistry, continue to change demand, which adds uncertainty to long-term projections.

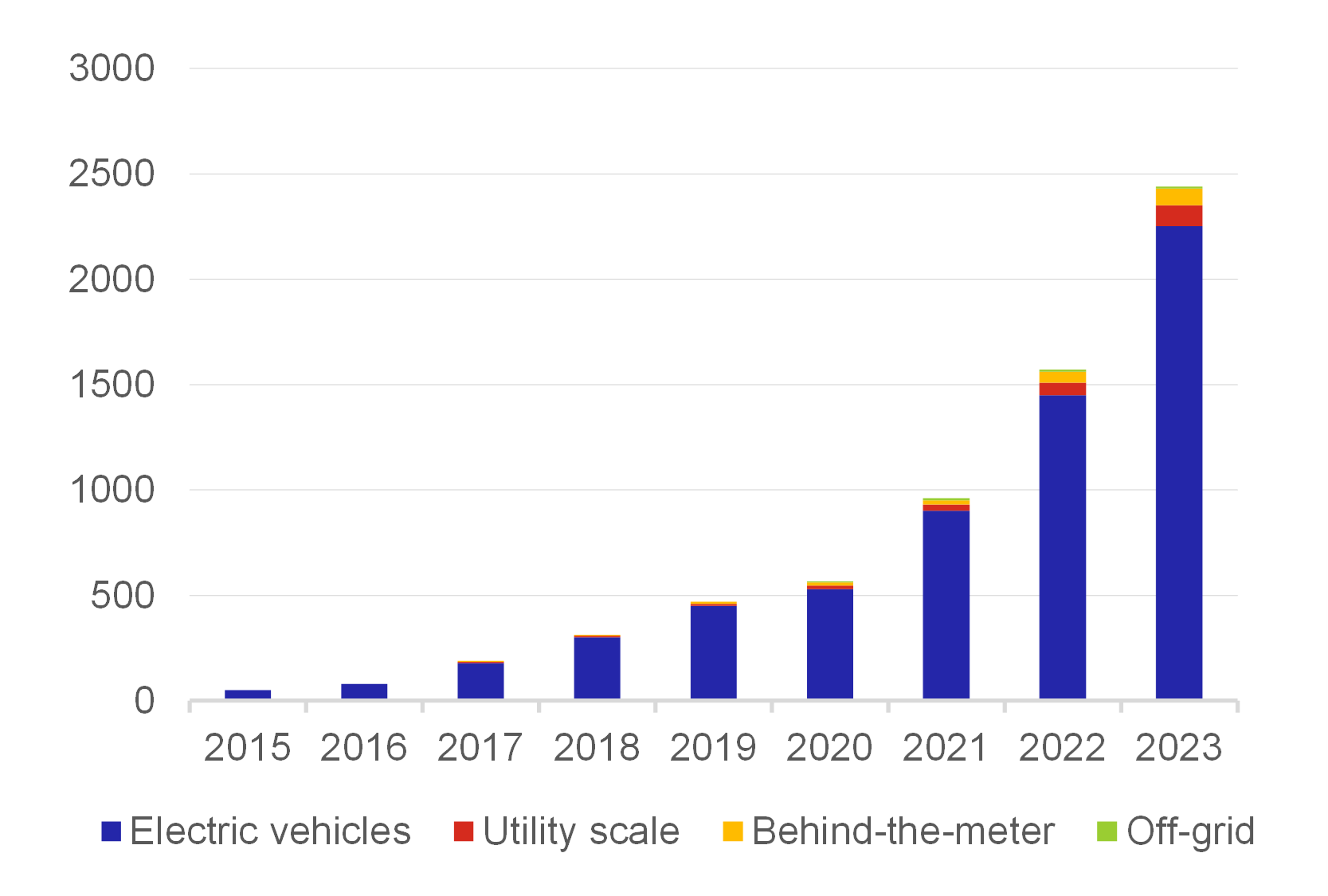

Battery and EV Recycling

The aim of recycling lithium-ion batteries that are mainly used in electric vehicles (Chart 14), is to recover valuable metals, such as lithium, nickel, cobalt, copper and aluminium. The situation with batteries for electric vehicles is complicated by the fact that three types of batteries are often used: NCA (nickel-cobalt-aluminium), NMC (nickel-manganese cobalt) and LFP (lithium ferrophosphate). There are concerns that as soon as sufficient raw materials from end-of-life electric vehicles are available for recycling, industry may have a greater financial motivation to recycle NCA and NMC batteries than LFP batteries due to the higher value of the materials. The recycling of LFP batteries focuses primarily on lithium, which is the most valuable element in the absence of nickel and cobalt. However, pyrometallurgical processes are not suitable for obtaining lithium and hydrometallurgical processes must be modified to increase the recycling efficiency from LFP batteries. The European Union’s Batteries Regulation tries to prevent this and orders a 70% recycling rate for lithium-ion batteries by 2030, including batteries with less-valuable chemicals such as LFP.

Chart 14 – Lithium-ion Batteries Dominate Electric Vehicles

(GWh)

Source: Global EV Outlook 2024, IEA

Note: Behind-the-meter – battery storage is situated at the customer behind the electricity meter

It is expected that the volume of discarded lithium-ion batteries available for recycling will increase significantly by 2030 (IEA, 2024c), as the first generation of batteries for electric vehicles reaches the end of its life. According to the IEA’s Stated Policies Scenario (STEPS), almost 80 GWh of batteries will be available for recycling in 2030. The global recycling capacity reached more than 300 GWh/year in 2023, of which more than 80% was in China, which was far in front of Europe and the United States, with less than 2%. Many technology developers and industry entities who are sure about the transition to electromobility are trying to position themselves on the future electric vehicle end-of-life management market and have announced significant expansions of capacities. If all the announced projects are implemented in full and on time, the global recycling capacity could exceed 1,500 GWh in 2030, of which 70% will be in China and around 10% each in Europe and the United States.

It is expected that until 2030 the main sources for recycling plants will be scrap from battery production for electric vehicles (50%) and end-of-life batteries for electric vehicles (20%). Despite the forecast increase in scrap from battery production and end-of-life electric vehicles, there is a potential risk of a significant overcapacity in the recycling sector until 2030. This could lead to financial problems for recycling companies and market consolidation, if stable sources of discarded batteries are not ensured.

The geographic distribution of end-of-life batteries introduces uncertainty into recycling efficiency and may differ from where they were originally purchased due to the used battery market or secondary applications. Developments in chemical technologies for batteries will also influence recycling, as some chemical technologies are more suitable for recycling thanks to the content of valuable metals. To effectively manage battery recycling, regulations need to be put in place to address issues related to battery transportation and tracking, and environmental safety. For example, the European Union’s current approach in the field of the circular economy for electric vehicle batteries may prevent electric vehicles and electric vehicle batteries from leaving the European Union, which brings benefits in terms of energy security, but may limit their reuse. In this regard, advanced economies and developing countries should strengthen their cooperation, to facilitate trading in used batteries and also to ensure corresponding strategies for the end of their life. For example, there could be incentives or contributions linked to extending the lifetime of vehicles through their use on international markets in used vehicles before recycling, if recycling in the destination market is guaranteed or if an EV battery is returned at the end of its lifetime.

Solar Panel Recycling

Solar panel recycling will play a key role in the wider context of the circular economy, where emphasis is placed on reducing the quantity of waste and material recovery. The industry’s ability to efficiently recycle and reuse solar panels will be of essential importance for maximising the environmental benefits of solar energy. In the last decade, there has been fast global expansion of photovoltaic systems, which has led to a large quantity of panels, whose lifetime is around 30 years[9]. At the current time, most solar panels are still within their operational lifetime, so the volume of panels being removed from operation is relatively low. It is expected, however, that this will change as soon as early installations reach the end of their lifetime (Chart 15).

Chart 15 – First Wave of Solar Panels for Recycling Will Come in 2030

(GW; right-hand-side axis: %)

Source: Special Report on Solar PV Global Supply Chains, IEA

Recycling of photovoltaic modules is technically complicated due to the non-homogeneous nature of end-of-life modules from the size, technology and composition viewpoints. Current panels were not designed with regard to recycling, which complicates the separation of elements. Various recycling practices have been developed, in particular in the European Union and the United States, but many of them still face economic problems because the income from the materials recovered often does not cover the recycling costs. The recycling of photovoltaic panels brings a number of benefits, including providing a secondary source of raw materials (e.g. aluminium, copper, glass, silicon and silver), reducing pressure on primary supplies, increasing energy security by providing a domestic supply alternative and mitigating the environmental, social and health impacts linked with raw material mining. In addition, recycling could cover 3–7% of the photovoltaic industry’s demand for certain materials in 2031–2040 and more than 20% in 2041–2050. Policies and regulations are still catching up with the need for comprehensive programmes for recycling solar panels. Some regions, such as the European Union, have introduced instructions in accordance with the directive on waste electrical and electronic equipment[10], which orders the recycling of photovoltaic panels. However, global regulations are still being developed. At the current time, the most common method is to mechanically break solar panels into separate materials such as glass, aluminium and semiconductor materials. This process includes crushing panels and separating various components using sorting techniques. Advanced recycling methods include the use of heat and chemical treatments to obtain valuable materials, such as silicon, silver and other metals. These processes can achieve higher recovery rates for such critical materials in comparison with mere mechanical recycling. Research is also taking place into the most effective recycling processes, such as those which can obtain almost 100% of the materials used in solar panels. This includes innovations in chemical leaching processes that can more efficiently recover silicon and other rare materials. At the current time, the costs of recycling solar panels can be higher than the value of the materials obtained, which is uneconomic. This is partially caused by the small volume of end-of-life panels available for recycling and the complicated nature of the recycling process. The collection, transport and processing of panels can be demanding, in particular in regions with a less-developed recycling infrastructure. Effective logistics are of fundamental importance so that recycling operations are cost-effective. Some manufacturers of solar equipment and specialised recycling companies have started to establish specialised recycling facilities. Companies like First Solar, which uses thin-film cadmium telluride technology, have developed proprietary recycling processes that enable the recovery of up to 90% of materials. It is expected that governments and regulatory bodies will introduce stricter requirements for recycling and incentives, which will further support the development of effective recycling processes.

In the future, the solar panel recycling market can also be expected to grow as more panels reach the end of their lifetime and as demand for the critical materials obtained from these panels increases. The first large wave of installed solar panels will reach the end of its lifetime in 2030, when the volume of panels available for recycling will rise sharply (Chart 15). This will probably lead to further investments in recycling infrastructure and technology.

Turbine Recycling

Wind turbine recycling is an increasingly important aspect of the wind energy sector. Their recycling includes the handling of various materials used in their design, such as steel, concrete, fibreglass and rare earth elements (Chart 16). This process is complicated with regard to the diversity of the materials used and the large dimensions of turbine parts. Seeing that the first wave of wind turbines built at the end of the 90s and start of the new millennium is being removed from operation, the importance of recycling turbines is even more urgent. A total of 85% to 95% of turbine materials such as steel, aluminium and copper can be easily recycled, but the blades require a more complicated process. At the current time, blades are ordinarily disposed of at landfills, but this option is becoming harder and harder to execute, because a number of countries, in particular Germany and Holland, have prohibited this practice. They are made from fibreglass and coated with a tough epoxy resin that is designed to withstand years of exposure to the elements.

Chart 16 – Composition of Wind Turbines

(%)

Source: 2015 Cost of Wind Energy Review, www.nrel.gov

According to Cooperman et al. (2021), by 2050 the quantity of waste from blades in the USA will be 2.2 m tonnes. Globally, it could be approximately 43 m tonnes by 2050 (Reuters, 2021). Recently, a number of companies have developed various technologies for the economical recycling of blade waste. One of the methods is the use of a liquid chemical solution to break down the blades into epoxy fragments and fibres. The epoxy resin is then made into high-quality epoxide. This technology is now being tested in Europe and the result would be low process costs with minimal greenhouse gas emissions. Further attempts are focused on a change to materials used to produce turbines, so that a new generation of blades that are easier to recycle is produced.

Conclusion

The transition to a green economy is a major challenge and opportunity for global society. Achieving the climate goals set out in the Paris Agreement requires a coordinated effort at international level, including reducing greenhouse gas emissions by transitioning to renewable energy sources and increasing energy efficiency. Despite rising investments and technological progress, the current attempts are insufficient to keep the global temperature under 1.5 °C above pre-industrial levels. The transformation to sustainability is not only necessary to protect the environment, but will also lead to significant economic and social benefits. It will create new jobs, increase energy security and improve public health thanks to reductions in pollution. Although renewables and clean technologies are on the rise, insufficient investment in critical materials and infrastructure, lax legislation and the concentration of supplies are significant risks for long-term stability and successfully meeting the targets set out in the Paris Agreement. Effective recycling and innovation in materials and clean energy are crucial to alleviating the pressure on the mining of natural resources and reducing environmental and geopolitical risks. In the coming years, it is necessary to strengthen international cooperation and accelerate political measures that will support the transition to a sustainable economy.

By Milan Frydrych. The opinions expressed in this article are his own and do not necessarily reflect the official position of the Czech National Bank.

Sources

BBC News: What is the Paris climate agreement and why does 1.5C matter?, February, 2024, https://www.bbc.com/news/science-environment-35073297

BBC News: When wind turbine blades get old what’s next?, March, 2024, https://www.bbc.com/news/business-68225891

Climate Action Tracker (2023). 2100 Warming Projections: Emissions and expected warming based on pledges and current policies. December 2023. Available at: https://climateactiontracker.org/global/temperatures/

CNN: Wind energy has a massive waste problem. New technologies may be a step closer to solving it, May, 2023, https://edition.cnn.com/2023/05/28/world/wind-turbine-recycling-climate-intl/index.html

Cooperman, A., Eberle, A., Lantz, E., (2021). Wind turbine blade material in the United States: Quantities, costs, and end-of-life options, Resources, Conservation and Recycling Volume 168, Article 105439, https://www.sciencedirect.com/science/article/abs/pii/S092134492100046X?via%3Dihub

CNB, (2023). Balance of payments report 2023.

European Environment Agency: Recycling materials from green energy technologies, April, 2024, https://www.eea.europa.eu/en/european-zero-pollution-dashboards/indicators/recycling-from-green-technology?activeTab=658e2886-cfbf-4c2f-a603-061e1627a515

IEA: COP28 Tripling Renewable Capacity Pledge, June, 2024a, https://iea.blob.core.windows.net/assets/ecb74736-41aa-4a55-aacc-d76bdfd7c70e/COP28TriplingRenewableCapacityPledge.pdf

IEA: Global Critical Minerals Outlook 2024, May, 2024b, https://iea.blob.core.windows.net/assets/ee01701d-1d5c-4ba8-9df6-abeeac9de99a/GlobalCriticalMineralsOutlook2024.pdf

IEA: Global EV Outlook 2024, April, 2024c, https://iea.blob.core.windows.net/assets/a9e3544b-0b12-4e15-b407-65f5c8ce1b5f/GlobalEVOutlook2024.pdf

IEA: Special Report on Solar PV Global Supply Chains, July, 2022, https://iea.blob.core.windows.net/assets/d2ee601d-6b1a-4cd2-a0e8-db02dc64332c/SpecialReportonSolarPVGlobalSupplyChains.pdf

IPCC, 2023: Sections. In: Climate Change 2023: Synthesis Report. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, H. Lee and J. Romero (eds.)]. IPCC, Geneva, Switzerland, pp. 35-115, doi: 10.59327/IPCC/AR6-9789291691647

IRENA 2024, Geopolitics of the energy transition: Energy security, International Renewable Energy Agency, Abu Dhabi.

National Minerals Information Center, 2023, U.S. Geological Survey Mineral Commodity Summaries 2023 Data Release: U.S. Geological Survey data release, https://doi.org/10.5066/P9WCYUI6.

National Renewable Energy Laboratory: 2015 Cost of Wind Energy Review, https://www.nrel.gov/docs/fy17osti/66861.pdf

Fragkos, P., Paroussos, L., (2018). Employment creation in EU related to renewables expansion, Applied Energy, Volume 230, Pages 935-945, https://doi.org/10.1016/j.apenergy.2018.09.032

United Nations, 2023: First global stocktake, https://unfccc.int/sites/default/files/resource/cma2023_L17_adv.pdf

Reuters: End of wind power waste? Vestas unveils blade recycling technology, May, 2021, https://www.reuters.com/business/sustainable-business/end-wind-power-waste-vestas-unveils-blade-recycling-technology-2021-05-17/

Recell center: Direct Recycling of Materials, https://recellcenter.org/research/direct-recycling-of-materials/

Rohde, R. A. and Hausfather, Z.: The Berkeley Earth Land/Ocean Temperature Record, Earth Syst. Sci. Data, 12, 34693479, https://doi.org/10.5194/essd-12-3469-2020, 2020.

Tamesol: Challenges in Recycling Solar Panels, February, 2024, https://tamesol.com/recycling-solar-panels-2024/

World Economic Forum: Solar panels have come a long way. Recycling them has not - but that could change, September, 2022, https://www.weforum.org/agenda/2022/09/solar-panels-have-come-a-long-way-recycling-them-has-not/

Keywords

critical minerals, mineral raw materials, clean energy, recycling, global warming

JEL Classification

Q54, Q42, Q34

[1] More here: https://www.europarl.europa.eu/topics/en/article/20230316STO77629/climate-change-the-greenhouse-gases-causing-global-warming.

[2] 1.5 °C as the average for the last 20 years, not the figure for a year.

[3] https://www.bbc.com/news/science-environment-35073297, in more detail here: https://climate.nasa.gov/news/2865/a-degree-of-concern-why-global-temperatures-matter/

[4] https://www.ipcc.ch/report/ar6/syr/downloads/report/IPCC_AR6_SYR_LongerReport.pdf

[5] One of the possible definitions is: A critical mineral is defined as a mineral or non-fuel mineral material that is essential to a country’s economic and national security and whose supply chain is vulnerable to disruption. Critical minerals are also characterised as performing an essential function in the production of a product the absence of which would have material consequences for economic or national security.

[6] A scenario that takes into account all implemented policies, including those that are in the approval/implementation process.

[7] A scenario that takes into account all implemented policies, commitments and promised future implementation. APS – STEPS = implementation gap.

[8] The Balance of payments report 2023, pp. 23-29, deals with the Czech Republic’s economic vulnerability.

[9] https://www.energy.gov/eere/solar/end-life-management-solar-photovoltaics

[10] Waste Electrical and Electronic Equipment Regulation (WEEE): https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX:02012L0019-20180704