Impacts of climate change on monetary policy

Climate change has become one of the most pressing challenges facing humanity today. Its impacts are becoming increasingly apparent, mainly in the form of extreme weather fluctuations, putting significant pressure on economies around the world. As the direct environmental impacts of climate change increase in intensity, accompanied by the impacts of climate-related green policies, this factor is also becoming increasingly important for the future optimum monetary policy response from central banks. Climate shocks going beyond the normal business cycle also entail fundamental changes in the structure of individual economies and hence risks to central banks’ ability to achieve price stability in the future. However, the current literature – from the perspective of the overall impacts on key macroeconomic variables, including the optimum settings of central bank interest rates – does not lead to clear conclusions. This article aims to identify individual shocks brought about by climate change and, based on a simulation of a global model for selected long-term climate scenarios, present recommendations for monetary policy-makers.

Motivation and objective

There has been a majority consensus over the on-going and worsening impacts of climate change and the need to start preparing for them on a global scale for a long time. Climate change reflects an increase in average temperature due to the elevated concentration of greenhouse gases in the atmosphere caused by human activity, in particular carbon dioxide generated by the combustion of fossil fuels (coal, natural gas and oil). This leads, among other things, to weather changes in the form of the dramatically increasing frequency and magnitude of natural disasters around the world, such as long periods of drought, heat waves, forest fires, or conversely floods, cyclones and hurricanes. This is a very significant global society-wide risk. Representatives of international institutions are still in disagreement as to the level of action they should take in the fight against climate change. The available studies on the macroeconomic impacts of climate change do not yet draw any clear conclusions about the overall impacts of this shock and the implications for monetary policy. There is only quite a strong consensus that the impacts of climate change need to be captured by analytical tools, so that they can be incorporated into decision-making processes, e.g. when deciding on monetary policy.

The aim of this text is to analyse the shocks that climate change brings, including quantifying the impacts on central banks’ monetary policy in the world’s three largest economies. To answer this question, output from the REMIND-MAgPIE climate model[1] for the three selected long-term climate scenarios proposed in line with the NGFS were used[2]. The economic impacts on individual economies were quantified based on simulations using a global NiGEM model[3] extended to include a climate block with a time horizon up to the end of 2050.

Climate change from a monetary policy perspective

There is a consensus in the current literature[4] that the impacts of climate change on monetary policy settings will be significant. The impacts of climate change can be broadly divided into long-term and short-term ones. From a long-term perspective, studies broadly agree that the repeated and more frequent occurrence of natural disasters will lead to slower potential growth, lower global economic growth and reduced demand due to higher precautionary savings and hence to a lower long-term natural real interest rate, see BoE (2022) and Mongelli et al. (2022). On the other hand, studies also admit that the implementation of transition policies to protect the climate, assuming innovation and investment growth, will, on the contrary, put upward pressure on natural real interest rates. Which influences ultimately prevail in the aggregate will depend on the path that climate policy takes in the world. In the short term, both physical and transition risks may affect inflation in either direction, depending on whether the impact on supply or demand is predominant (Batten et al. (2020)). There is some parallel experience with the COVID-19 pandemic, which, like any other type of natural disaster, manifested itself to a greater extent in the form of a negative supply shock and the related need for a monetary policy response in a restrictive direction, see, for example, Brůha, Motl and Tonner (2021).

However, the literature describes the specific direction of the monetary policy response to the impacts of climate change very cautiously and ambiguously. Climate change will affect price stability through its impact on macroeconomic indicators such as inflation, output, employment, interest rates, investment and productivity (ECB (2021)). In addition, fiscal policy measures aimed at mitigating the effects of climate change, which also affect monetary policy settings, should be considered. Climate change will also affect the value and risk profile of assets, which may lead to an undesirable build-up of financial risks, see NGFS (2019a). The disruption of financial markets and the associated repricing of climate risks could significantly reduce the prices of some assets during the transition to a low-carbon economy. This will lead to a correction in the financial market with spillovers to the real economy and impacts on monetary policy settings. Further studies by NGFS (2020a) and Bylund (2020) confirm the above conclusions, although they point out that the scale and transmission of these impacts remain highly uncertain. These works underline that the primary objective of central banks is mostly to ensure low and stable inflation; other (e.g. climate policy) objectives can only be achieved if they are in line with price stability, because central banks cannot arbitrarily extend their mandate, see, for example, BoE (2022).

Economic impacts of climate change and green climate policy

The risks stemming from the impacts of climate change can be divided into “physical”, related to extreme weather events, and “transition”, reflecting the implementation of climate policy. Physical risks include both various types of natural disasters and the negative impacts of high temperatures (“heat waves”) on human health, which in turn can lead to the migration of large populations and geopolitical conflicts, see Brzoska and Fröhlich (2015) and Rigaud et al. (2018). The impacts of climate change will affect aggregate supply and demand. On the supply side, rising average temperatures may reduce both productivity and labour availability, as could devastating natural disasters and the associated forced migration of large populations. Extreme events can also physically destroy capital and redirect investments from expanding production into reconstruction work. Shortfalls in the production factors of labour and capital, accompanied by the frequent disruption of global trade chains and division of labour will thus reduce the potential and production capacity of the world’s economies. In terms of demand, physical risks will affect the preferences and patterns of economic agents’ behaviour, while elevated uncertainty will negatively affect private consumption (precautionary savings) and company consumption (deferred investment). Physical risks will also have a negative impact on asset prices and the financial sector as a whole in the form of growing problems in arranging credit, including major challenges in, for example, the insurance sector. Transition risks represent the economic costs of gradually refocusing towards a low-emission economy. They are due to changes in climate policy, unavoidable technological changes that will require major investments, or changes in consumers’ preferences and habits due to new conditions. They may include, for example, new forms of taxation and regulatory restrictions, an increase in the prices of emission allowances, a carbon tax and others. This may cause a decline in the value of certain corporate assets as well as a decline in corporate profitability in some industries. These changes thus also pose risks to the financial system, with further impacts on the real economy. A gradual increase in global temperatures will lead to a shift of resources away from production and innovation towards activities linked to adaptation to climate change. For example, agricultural commodity prices may increase due to lower supply, as some agricultural land will be used for the cultivation of energy crops, thus leaving less land for the cultivation of agricultural crops.

Long-term climate scenarios and model assumptions

Standardised long-term climate scenarios under Phase IV proposed by the NGFS were used to assess the economic impacts of climate change. Climate scenarios, which aim to map potential risks to the financial system in the long term, are broken down into four categories in accordance with the ambition and timing of implementing climate policies, see NGFS (2023). The first category includes orderly transition scenarios, which assume, in particular, relatively weak physical risks over the entire horizon due to the launch of a timely, credible and internationally coordinated climate policy. The second category consists of disorderly transition scenarios, which are characterised by relatively significant materialisation of transition risks arising from late implementation of climate policy or differences in the green transition across countries and sectors. The third category includes scenarios with insufficiently ambitious or no climate policy (a hot house world), which assume low or no transition risks and high or even extreme physical risks due to a predicted significant increase in the average global temperature. The latest new category is too-little-too-late scenarios, which reflect delays and international differences in the ambition of climate policy, which entail increased transition risks in some countries and high physical risks in all countries due to the overall low effectiveness of the green transition. In total, seven baseline climate scenarios are defined by the NGFS within these categories.

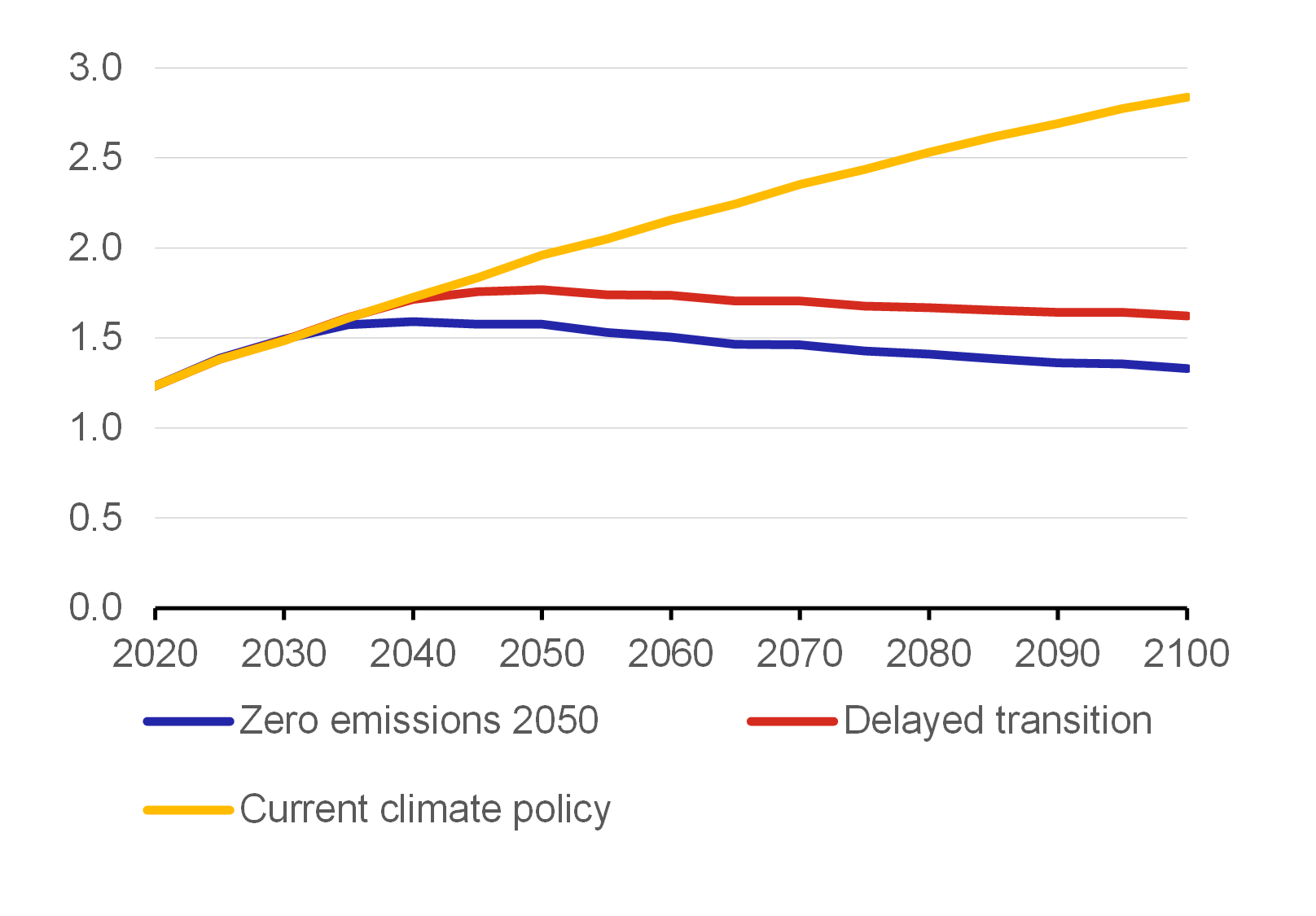

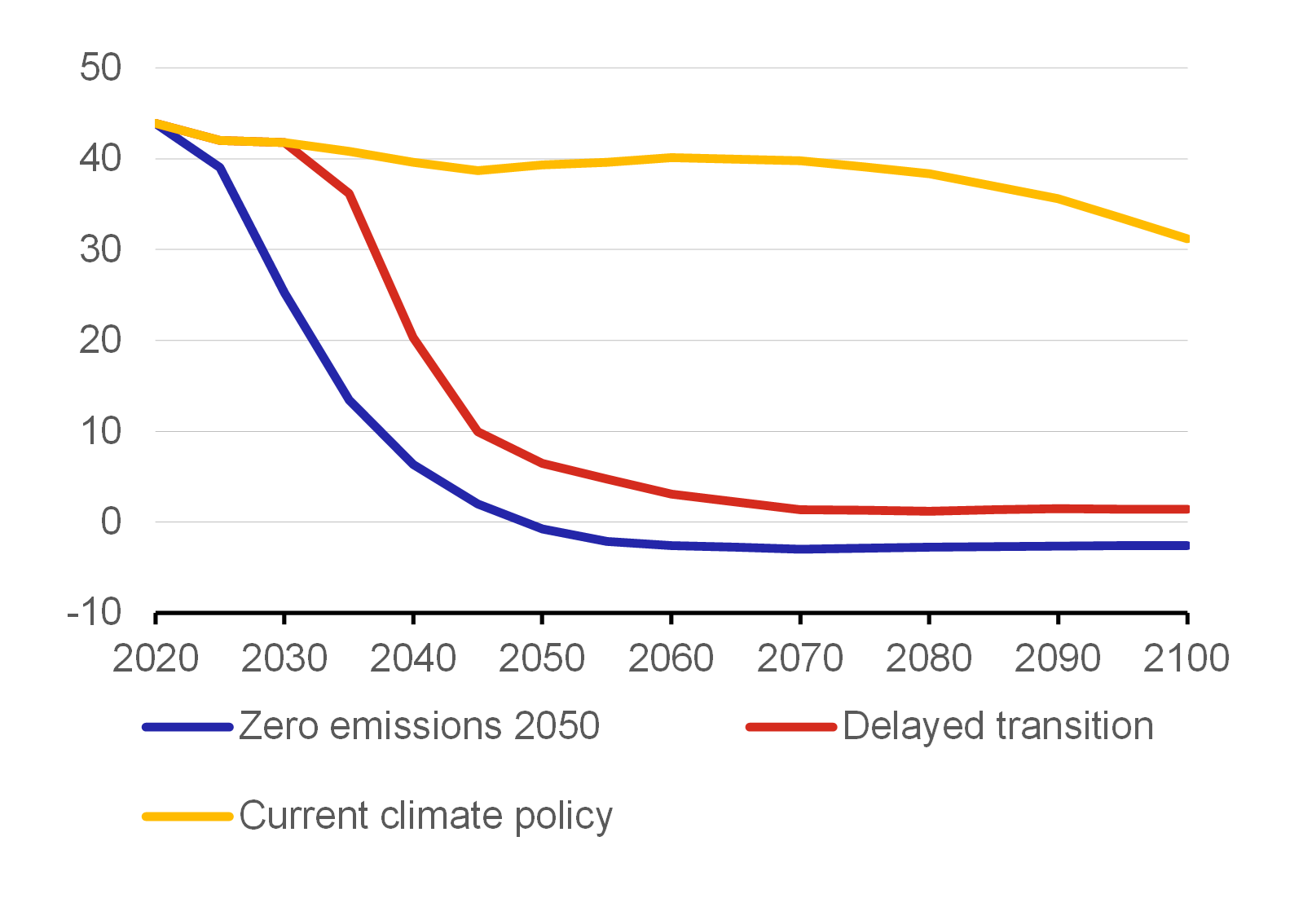

The simulations of the economic impacts of climate change using the NiGEM global model are based on updates to three selected hypothetical scenarios for possible future developments. The first – controlled – “zero emissions 2050” scenario corresponds to limiting global warming in the form of an increase in the average temperature of no more than 1.5 °C compared to 1850–1900 (see Chart 1). After having been slightly exceeded in 2035–2060, this target is achieved again in the second half of the current century. The average temperature increase is expected to fall below 1.4 °C at the end of the century. This scenario is considered quite ambitious, as it assumes the immediate implementation of a strict climate policy, which should lead to net zero CO2 emissions being achieved by 2050 (see Chart 2). The second – uncontrolled – “delayed transition” scenario is characterised by the slower implementation of a global climate policy, leading to a reduction in global CO2 emissions after 2030 compared to the previous scenario. Until 2030, this scenario assumes the same use of fossil energy sources as in the “current climate policy” scenario. This will lead to an increase in the median temperature of almost 1.8 °C between 2045–2050. The increase will then fall to 1.6 °C by the end of the century, following post-2030 climate measures in line with long-term temperature targets. The third – hot house world – “current climate policy” scenario is characterised by a continuation of global climate policy in line with current trends in the use of fossil energy sources and only a very slow pace of CO2 reduction. A gradual rise in the global average temperature that will approach 3 °C at the end of the century is consistent with this scenario.

Chart 1 – Average temperature profiles for individual climate scenarios compared to 1850–1900

(°C)

Source: REMIND-MAgPIE-MAGICC global climate model.

Chart 2 – Total CO2 emissions in the world

(Gt CO2/year)

Source: REMIND-MAgPIE global climate model.

The first group of risks modelled consists of physical shocks, i.e. the direct impacts of climate change, which will have a negative impact on both supply and demand. For the above three climate scenarios, negative supply effects as a part of physical shocks have been calibrated for individual world economies on the basis of Kalkuhl and Wenz (2020), building on the projected global temperature profiles corresponding to the selected climate scenarios. Global warming and rising heat waves will have a negative impact on human health, leading to a decrease in labour availability and productivity. The increasing scale and strength of natural disasters will lead to the total or partial physical destruction of capital in the areas hit hardest. Reducing the production factors of labour and capital will lead to a decline in the potential of individual economies and hence to a decrease in total global production capacity (supply). On the demand side, physical shocks will adversely affect private consumption and investment, whose decline was derived from the negative impacts of supply effects on real economic activity. Overall, physical shocks will lead to a decline in GDP. In the case of prices, by contrast, inflationary effects stemming from supply disruptions and anti-inflationary factors reflecting the decline in demand have opposite effects.

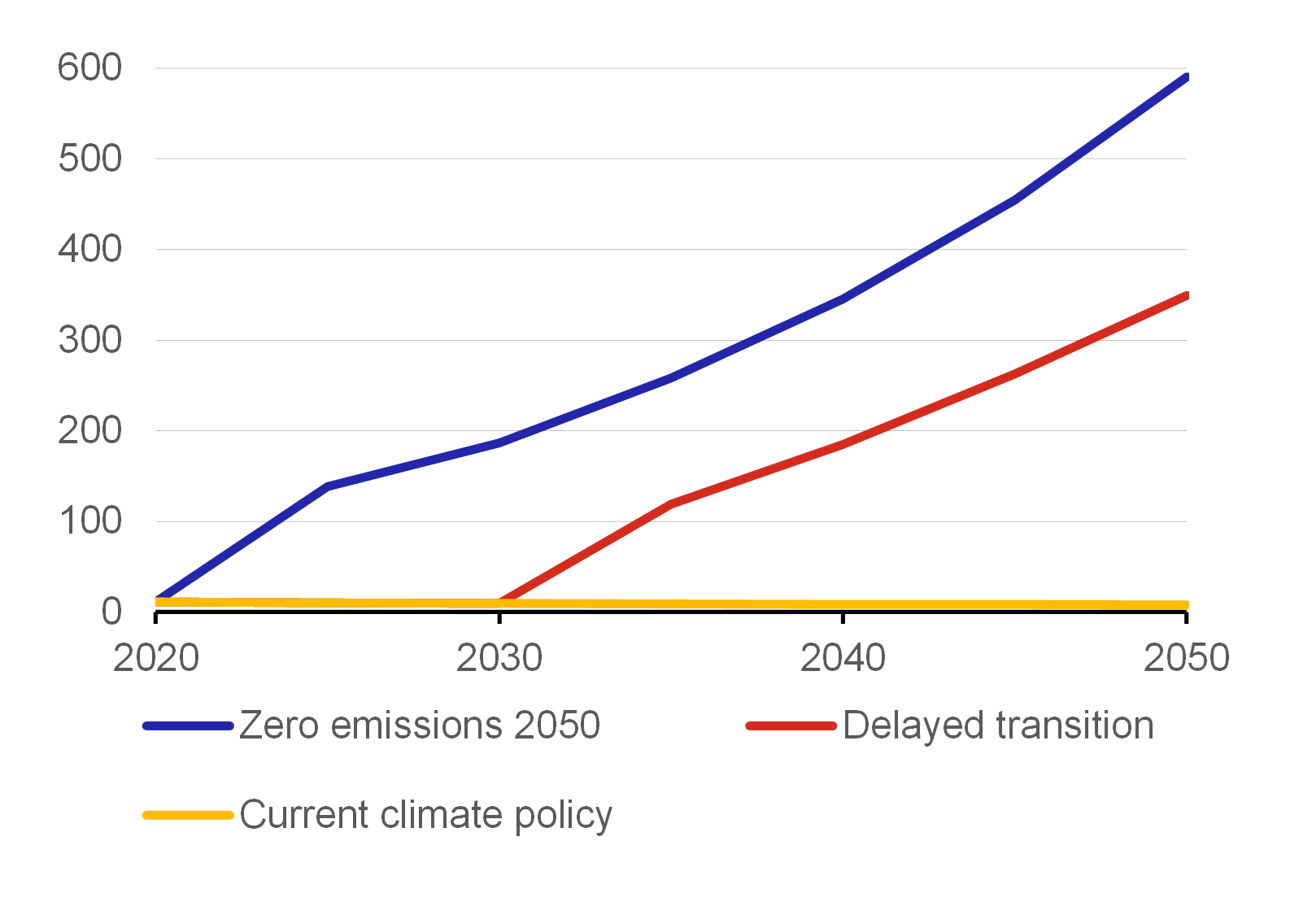

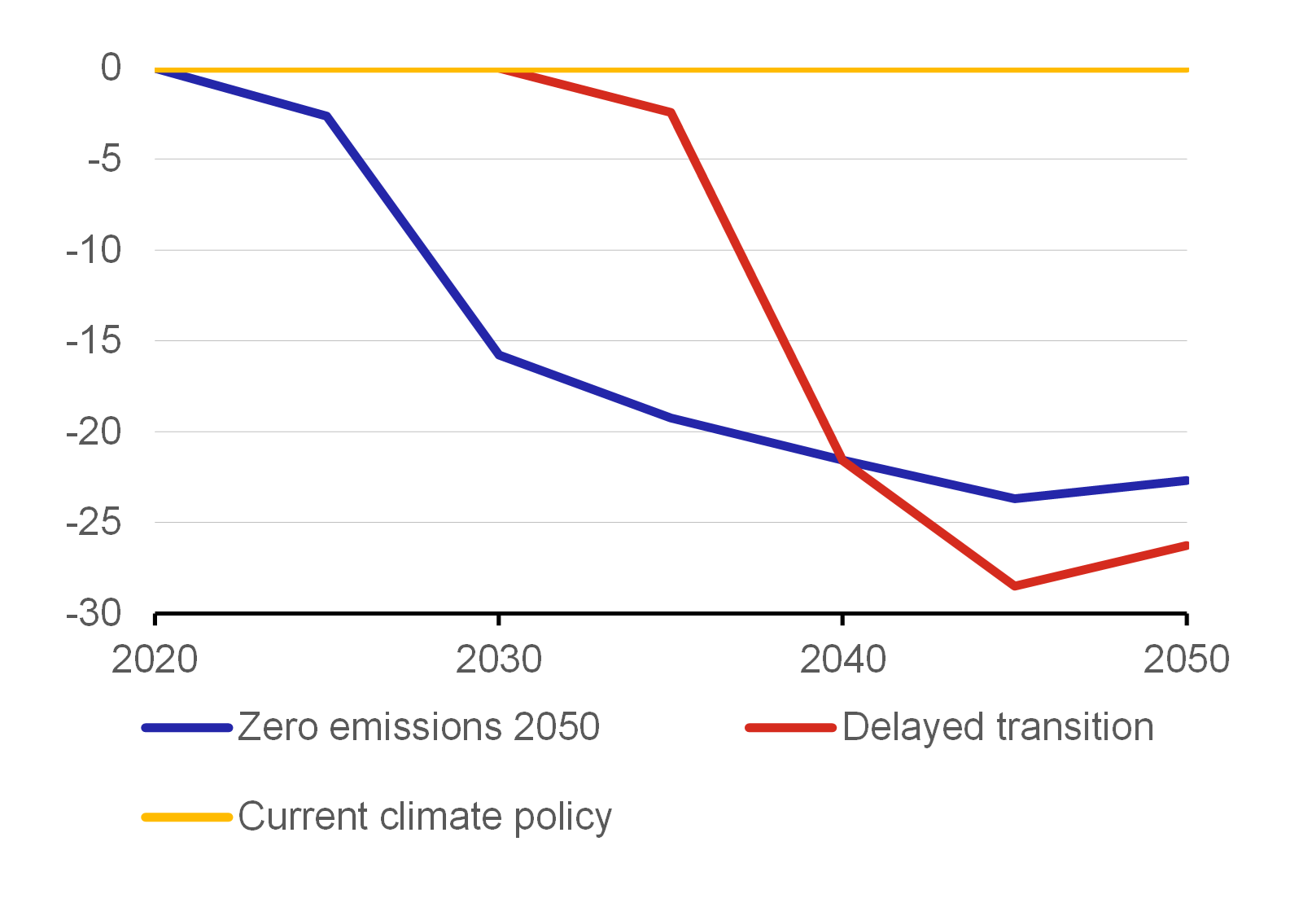

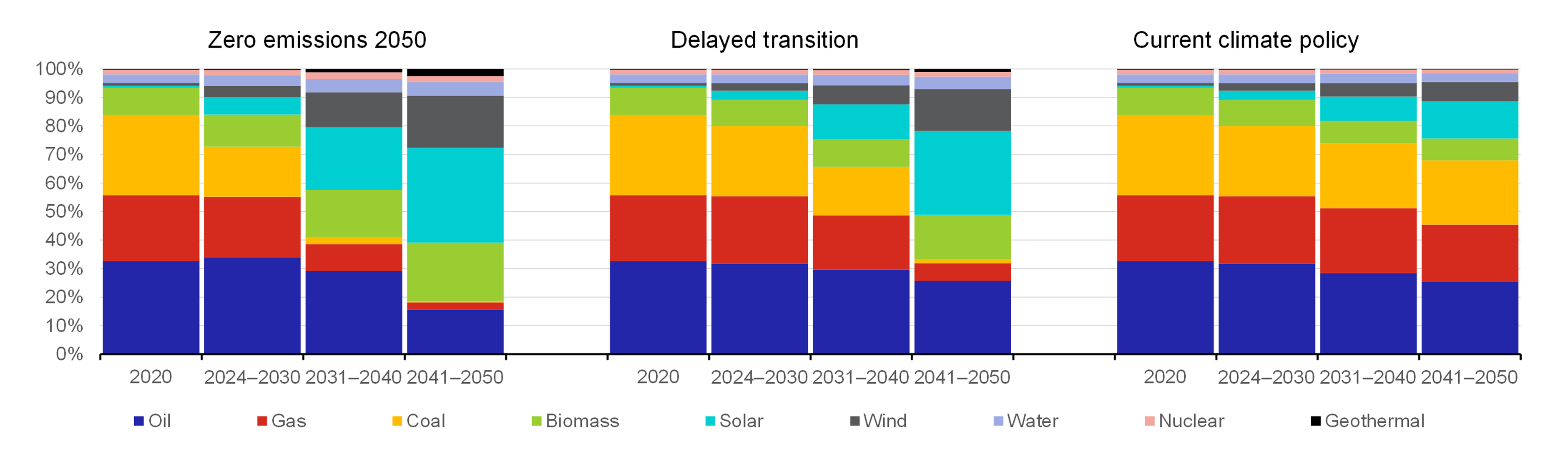

The second group of modelled risks includes transition shocks, i.e. intermediated impacts reflecting the implementation of global climate policy. The calibration of transition shocks for individual economies in the world was performed based on the outputs of the REMIND-MAgPIE global climate model only for the “zero emissions 2050” and “delayed transition” climate scenarios, as the “current climate policy” scenario does not consider transition shocks. As regards transition shocks, the model simulations assume an increase in carbon taxes for both climate scenarios (see Chart 3) and a decline in the energy intensity of production (see Chart 4). In addition, owing to their different structures, shocks corresponding to an assumed decline in fossil energy consumption (coal, oil and gas) were calibrated for the individual climate scenarios separately for the individual economies, see Chart 5. A gradual decline in the share of fossil inputs in production will result in a temporary drop in productivity (a negative supply shock) and will therefore be another inflationary factor. Falling consumption and prices of fossil commodities will have the opposite effect on prices, while consumption of renewable energy sources preferred by global climate policy will increase over time.

Chart 3 – World CO2 price

(USD/t CO2)

Source: REMIND-MAgPIE global climate model.

Chart 4 – Energy intensity of production worldwide

(deviations from “current climate policy” scenario in %)

Source: REMIND-MAgPIE global climate model.

Chart 5 – World energy consumption assumptions by source of production for each climate scenario

(%)

Source: REMIND-MAgPIE global climate model.

Carbon tax revenues will have a positive effect on the public budgets of national governments in the form of a new additional source of income. The model simulation of the “zero emissions 2050” climate scenario assumes that half of revenues stemming from an increase in the carbon tax beginning from the start of the forecast horizon will be returned to the economy by national governments in the form of investment. The remaining half of the carbon tax revenues will be used to reduce government debt. In the case of the “delayed transition” climate scenario, where the implementation of climate policy is delayed and carbon tax increases only after 2030, leading to lower overall revenues than in the previous scenario, these additional revenues are redistributed by national governments back to the economy through direct tax cuts. In addition, in this scenario, this positive fiscal shock after 2030 will be dampened over the next two years by negative sentiment of households and companies, which will be shaken by sudden changes in the course of climate policy. The delay in implementing climate policy will be reflected in the lower willingness of households to consume and an increase in precautionary savings. The increased uncertainty caused by the rapid introduction of new regulatory measures will also lead to an increase in the risk premium and lower corporate investment activity.

Impacts of climate change on GDP and inflation without a monetary policy response

In order to quantify the overall impacts of the interactions between different combinations and types of shocks for the individual climate scenarios, a simulation was first performed using the NiGEM model without a monetary policy response.[5] In the case of physical shocks, all three scenarios inevitably lead to greater or smaller direct negative impacts of climate change on GDP (see Chart 6). These effects reducing real economic activity are joined in the “zero emissions 2050” and “delayed transition” scenarios by the impacts of transition shocks reflecting the implementation of climate policy, which on the one hand further deepens the decline in GDP. However, if climate policy is implemented in good time, see the “zero emissions 2050” scenario, and if carbon tax revenues are used and partly distributed as government investment back into the economy, the negative impacts on GDP can be significantly eliminated or, in this scenario, even a positive overall impact on real economic activity can be achieved in the short term. In the event of a later implementation of climate policy after 2030, see the “delayed transition” scenario, in addition to the negative impacts reflecting physical shocks, temporarily worse sentiment among households and companies is added to the negative impacts of transition shocks. While both scenarios sooner or later have a negative impact on GDP, unlike the “current climate policy” scenario they lead to a very sharp slowdown in global warming and the negative effects on the economies of the world after 2050 will be low in these scenarios. On the contrary, the “current climate policy” scenario will significantly amplify the negative impacts of climate change over time, which will entail irreversible damage to the environment, human health and huge economic costs after 2050. Delaying the implementation of climate policy will require a stronger response in the future, with the effectiveness of such a response being reduced over time as a result of increased global temperature, and the damage caused by global warming will increase.

Chart 6 – Impacts on global real GDP

(deviations from climate-neutral baseline in %)

Source: Own calculations using the NiGEM model based on the outputs of the REMIND-MAgPIE climate model.

The cost of implementing global climate policy would be faster overall global price growth. Coupled with mostly negative impacts on GDP, this would cause stagflation tendencies overall. The inflationary effect in the “zero emissions 2050” scenario and the “delayed transition” scenario are dominated mainly by transition shocks together with the inflationary impacts of a positive demand shock reflecting expansionary fiscal policy (see Chart 7). Overall, inflation is thus highest in the near future in the case of the “zero emissions 2050” scenario, reflecting the assumed partial inflationary impact of government investment in an effort to support economic growth and mitigate the negative impacts of shocks arising from climate change and the implementation of global climate policy. By contrast, this effect is more moderate in the “delayed transition” scenario, as the carbon tax increase occurs with a lag and to a lesser extent. The slowest inflation over the period up to the end of 2050 is implied by the “current climate policy” scenario, which does not include transition shocks, only those of a physical nature, which, however, are the most inflationary in this scenario. On the one hand, a very slight but still positive deviation in prices in the event of physical shocks following a sharp downturn in real economic activity reveals the presence of strong negative supply-side effects, which slightly outweigh the strong anti-inflationary effects reflecting falling demand. These overall inflation pressures will strengthen further over time, as continuing global warming further disrupts supply due to lower efficiency of the use of production factors in the global economy and negative anti-inflationary demand effects will only partly dampen such growth. By contrast, in the “zero emissions 2050” scenario, the inflationary effects related to physical shocks are moderate, as upward negative supply-side effects stemming from lower global production factor productivity are largely dampened by anti-inflationary demand effects. In the “delayed transition” scenario, slightly inflationary physical shocks are temporarily dampened overall in the short term by anti-inflationary shocks reflecting the temporary negative sentiment of households and companies due to more forceful implementation of global climate policy after 2030.

Chart 7 – Impacts on annual consumer price inflation around the world

(deviations from the climate-neutral baseline in pp)

Source: Own calculations using the NiGEM model based on the outputs of the REMIND-MAgPIE climate model.

Impacts of climate change on monetary policy interest rates

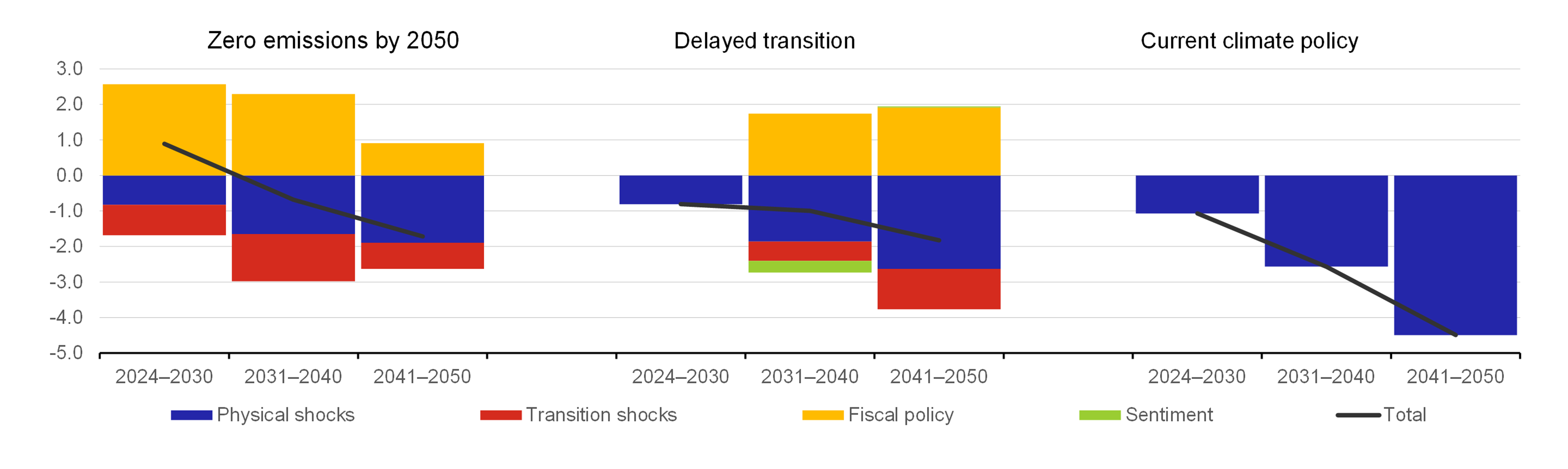

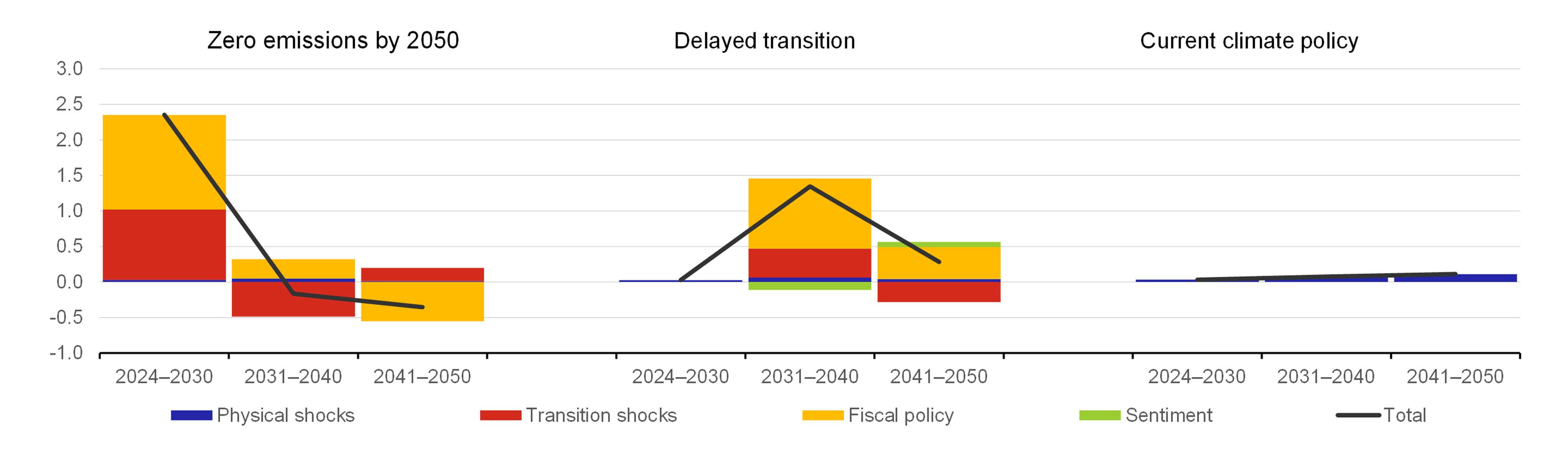

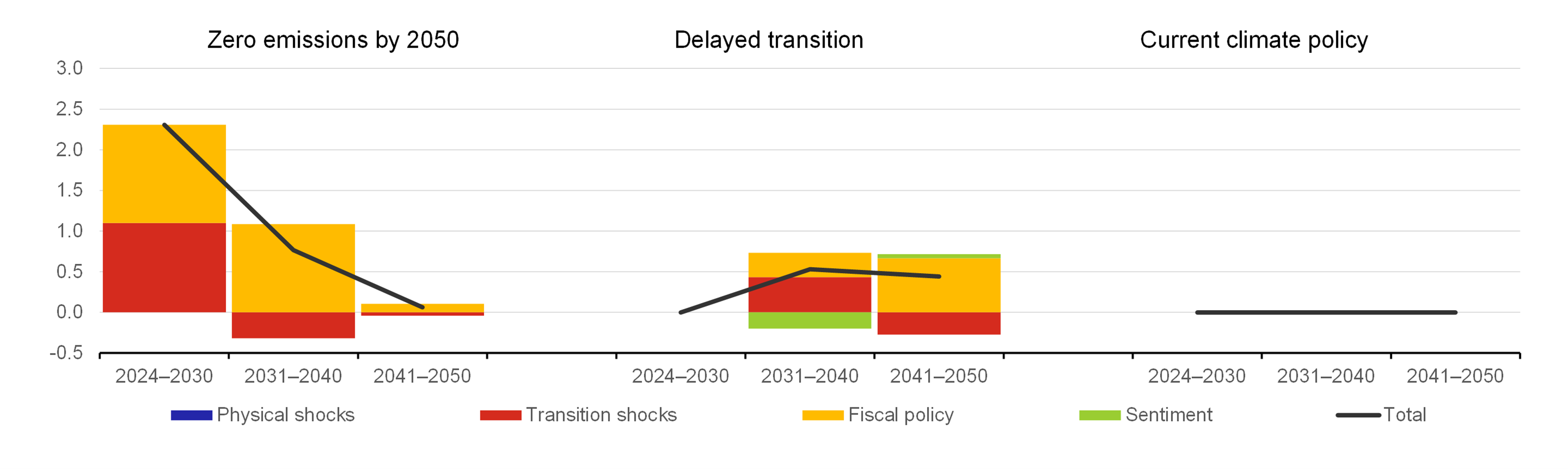

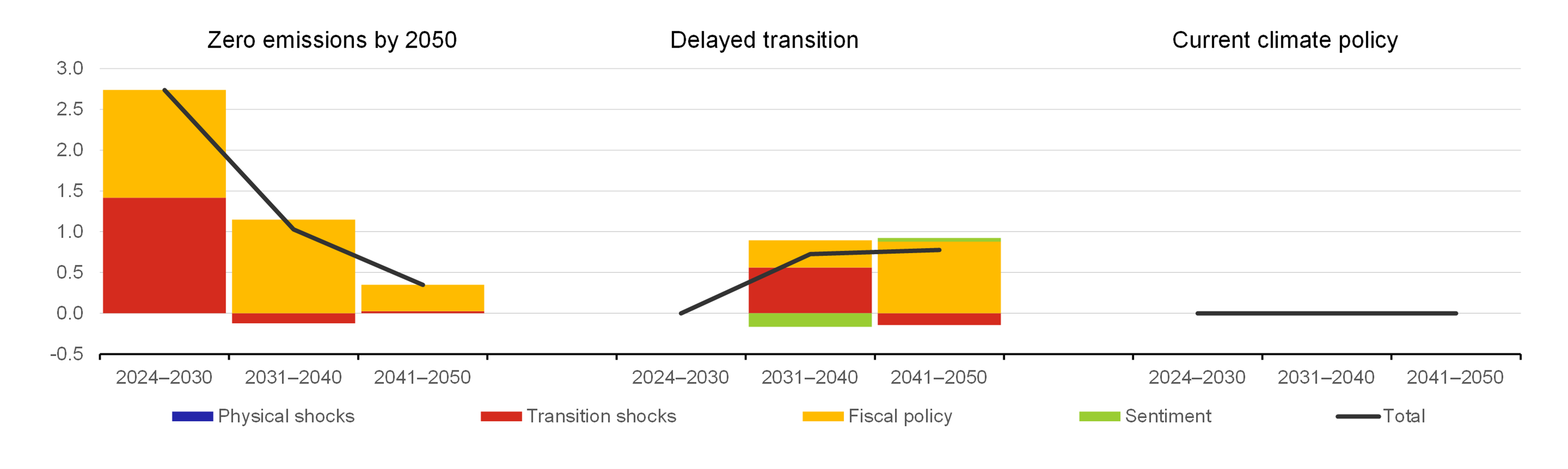

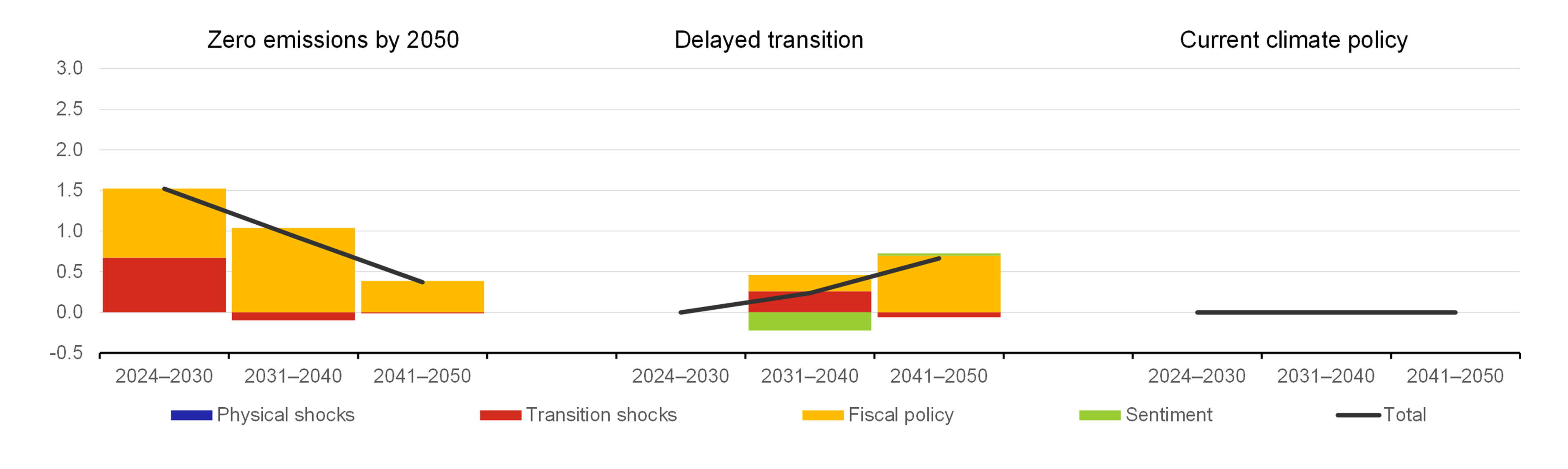

The overall inflationary effect of climate change leads to a need for tighter central bank monetary policies. Charts 8, 9 and 10 show the decomposed endogenous model monetary policy response using the examples of the central banks of the USA (Fed), China (PBoC) and euro area (ECB). The results reveal a restrictive monetary policy response for all three central banks. In the case of its intensity, the differences are due to a different calibration of the climate shocks, reflecting the specific structure and energy dependence of these selected three largest economies.

Chart 8 – Impact on monetary policy interest rates in the USA (Fed)

(deviations from the climate-neutral baseline in pp)

Source: Own calculations using the NiGEM model based on the outputs of the REMIND-MAgPIE climate model

Note: Forward-looking monetary policy does not react to physical shocks, which are modelled as unexpected.

Chart 9 – Impact on monetary policy interest rates in China (PBoC)

(deviations from the climate-neutral baseline in pp)

Source: Own calculations using the NiGEM model based on the outputs of the REMIND-MAgPIE climate model

Note: Forward-looking monetary policy does not react to physical shocks, which are modelled as unexpected.

Chart 10 – Impact on monetary policy interest rates in the euro area (ECB)

(deviations from the climate-neutral baseline in pp)

Source: Own calculations using the NiGEM model based on the outputs of the REMIND-MAgPIE climate model

Note: Forward-looking monetary policy does not react to physical shocks, which are modelled as unexpected.

The biggest increases in interest rates are observed in the US and Chinese economies, while the rate of monetary policy restriction in the euro area is lower. This reflects the fact that, whereas the US economy is a major global exporter of fossil energy commodities, the euro area economy is an importer of fossil energy commodities. Climate policy putting downward pressure on fossil fuel consumption, the price of which will decrease over time, will have a more negative impact on the US economy. This will also be reflected in a stronger euro against the dollar, which will dampen the inflationary effect on the euro area economy. By contrast, the Chinese economy displays the highest energy intensity of production. If it decreases, this will have a more inflationary effect and a negative effect on GDP by restricting supply. In contrast, the euro area economies, especially Germany, started relatively quickly in previous years, which is reflected in the related visible economic costs.

The overall increase in interest rates is dominated by positive demand-pull inflationary effects combined with negative supply and cost factors. Upward pressures on interest rates are most visible in the near future until 2030 in the “zero emissions 2050” scenario, where, on the one hand, a very sharp rise in the carbon tax and a related rise in prices of production inputs takes place amid a rapid pace of decline in the energy intensity of production. On the other hand, these additional budget revenues contribute to a stronger inflationary effect via expansionary fiscal policy. The need for tight monetary policy then decreases in the coming decades, as these effects gradually fade, but the deviation in interest rates remains positive over the entire forecast horizon. This applies even if the “delayed transition” scenario materialises, where an increase in interest rates – which, moreover, is temporarily dampened by the anti-inflationary effect of worsened economic sentiment – occurs with a lag, but interest rates remain constantly elevated until the end of 2050. In the simulation of the “zero emissions 2050” and “delayed transition” scenarios, transition shocks are modelled by their very nature as expected to which forward-looking monetary policy reacts, whereas the very opposite is true in the “current climate policy” scenario. However, this scenario also shows gradually intensifying inflationary pressures, which will increase significantly further after 2050 owing to continued growth in the global average temperature and a rising number and magnitude of devastating natural disasters reducing production capacity. Sooner or later, this will require tighter monetary policy anyway.

Conclusion

The model simulations show that, overall, climate change will have distinct global stagflation effects, which pose a significant risk to central banks with regard to safeguarding price stability in the future. This long-term, worsening partial shock going beyond the normal business cycle will foster higher inflation and slower economic growth. This is shown by analyses carried out through the NiGEM global model based on REMIND-MAgPIE climate model outcomes based on three hypothetical climate scenarios, i.e. the “zero emissions 2050”, “delayed transition” and “current climate policy” scenarios designed in line with the NGFS. The simulations include the direct impacts of climate change (“physical shocks”), which overall will lead to a sharp fall in GDP amid moderate price growth, as inflationary effects stemming from supply disruptions outweigh anti-inflationary effects reflecting lower demand. The “zero emissions 2050” and “delayed transition” simulations include additional risks (“transition shocks”) that take into account the impacts of implementing a climate policy to reduce CO2 emissions, i.e. an increase in carbon tax, a decline in the energy intensity of production, a decline in fossil energy (coal, oil, gas) consumption and an increase in renewable energy consumption. These additional factors are also reflected in the inflationary effect overall, as it is a mix of a positive cost and negative supply shock, to which the impact of expansionary fiscal policy is added. In the absence of transition shocks, the slowest – but still positive – inflation in the period up to the end of 2050 is implied by the “current climate policy” scenario. In this scenario, which has a minimal effect on reducing CO2 emissions, the prevailing inflationary negative supply effects should further increase over time due to continued global warming.

The impacts of climate change and green climate policy will lead to a need for tighter monetary policy in the world. This conclusion resulting from the model simulations is demonstrated using the example of the monetary policy of the central banks of the USA (Fed), China (PBoC) and euro area (ECB). In terms of intensity, the impacts on individual countries and regions of the world economy differ considerably. The biggest increases in interest rates are due to the structure of the economies and the energy intensity of production in the USA and China, whereas the rise in interest rates in the euro area is more moderate. The optimum level of monetary policy restrictions is the highest for all three economies in the “zero emissions 2050” scenario. Although the need for tighter monetary policy is decreasing in the coming years, a positive deviation in interest rates compared to the climate-neutral baseline scenario persists over the entire horizon until 2050. In the “delayed transition” scenario, interest rates increase beyond 2030 due to the postponement of the implementation of climate protection policies and remain steadily elevated until 2050. Given the intensifying inflationary effect, an increasing need for tighter monetary policy can also be expected in the future in the “current climate policy” scenario.

Monetary policy cannot resolve climate change, but climate change will have major macroeconomic implications for monetary policy makers. The analysis suggests that ensuring price stability and maintaining the credibility of their regimes will be the greatest benefit and role of central bank monetary policy in the ongoing fight against climate change and the transition to green zero-emission economies.

Author: Martin Motl. The opinions expressed in this article are his own and do not necessarily reflect the official position of the Czech National Bank.

References

Batten, S., Sowerbutts, R., Tanaka, M. (2020). Climate change: Macroeconomic impact and implications for monetary policy. Book chapter in: Ecological, Societal, and Technological Risks and the Financial Sector, July 2020, https://www.frbsf.org/economic-research/events/2019/november/economics-of-climate-change/files/Batten-Sowerbutts-Tanaka-Climate-change-Macroeconomic-impact-and-implications-for-monetary-policy.pdf.

BoE (2022). Climate Change: Possible Macroeconomic Implications. Bank of England, Quarterly Bulletin, October 2022. https://www.bankofengland.co.uk/quarterly-bulletin/2022/2022-q4/climate-change-possible-macroeconomic-implications.

Brůha, J., Motl, M., Tonner, J. (2021). Assessment of the impacts of the pandemic on the world’s major economies: A crisis of supply or demand? Global Economic Outlook, Czech National Bank, May.

Brzoska, M., Fröhlich, C. (2015). Climate Change, Migration and Violent Conflict: Vulnerabilities, Pathways and Adaptation Strategies. Migration and Development 5 (2): pp. 190–210. March 2015.

Bylund, E., Jonsson, M. (2020). How does climate change affect the long-run real interest rate? Economic Commentaries, Sveriges Riksbank, No. 11, 2020, https://www.riksbank.se/globalassets/media/rapporter/ekonomiska-kommentarer/engelska/2020/how-does-climate-change-affect-the-long-run-real-interest-rate.pdf.

Cantelmo, A. (2020). Rare disasters, the natural interest rate and monetary policy. Banca d'Italia Working Paper, 1309, December 2020, en_tema_1309.pdf (bancaditalia.it).

ECB (2021). ECB presents action plan to include climate change considerations in its monetary policy strategy. Press Release, 8 July 2021, https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210708_1~f104919225.en.html.

Economides, G., Xepapadeas, A. (2018). Monetary policy under climate change. Bank of Greece Working Paper, 247, May 2018, https://www.bankofgreece.gr/Publications/Paper2018247.pdf.

Hantzsche, A., Lopresto, M., Young, G. (2020). Using NiGEM in uncertain times: Introduction and overview of NiGEM. Cambridge University Press, January 2020.

Kalkuhl, M., Wenz, L. (2020). The impact of climate conditions on economic production. Evidence from a global panel of regions. Journal of Environmental Economics and Management, 103, 102360, https://www.sciencedirect.com/science/article/pii/S0095069620300838

Mongelli, F. P., Pointner, W., Van Den End, J. W. (2022). The Effects of Climate Change on the Natural Rate of Interest: A Critical Survey. European Central Bank Working Paper Series. November 2022. https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2744~9c3a54be4f.en.pdf

NGFS (2019a). A call for action: Climate change as a source of financial risk. First Comprehensive report, Network for Greening the Financial System, Paris, France. https://www.ngfs.net/sites/default/files/medias/documents/synthese_ngfs-2019_-_17042019_0.pdf.

NGFS (2019b). Macroeconomic and financial stability: Implications of climate change. Technical supplement to the First NGFS Comprehensive Report, Network for Greening the Financial System, Paris, France, ngfs_research_priorities_final.pdf.

NGFS (2020a). Climate Change and Monetary Policy: Initial takeaways. Network for Greening the Financial System, prepared by the workstream of the NGFS, chaired by Sabine Mauderer from the Deutsche Bundesbank. https://www.bundesbank.de/resource/blob/835284/ecd8086b2ef01c59b2313894710aae48/mL/climate-change-and-monetary-policy-data.pdf.

NGFS (2023). Climate Scenarios Technical Documentation. https://www.ngfs.net/sites/default/files/media/2024/01/16/ngfs_scenarios_technical_documentation_phase_iv_2023.pdf

Rigaud, K. K., De Sherbinin, A., Jones, B., Bergmann, J., Clement, V., Ober, K., Schewe, J., Adamo, S., McCusker, B., Heuser, S., Midgley, A. (2018). Groundswell: Preparing for Internal Climate Migration. World Bank, Washington, DC.

Keywords: climate change, monetary policy, macroeconomic modelling

JEL classification: E37, E58, G11, G28, O44, Q43

[1] The Regional Model of Investment and Development (REMIND) is a model encompassing individual regions of the world economy with a focus on the energy sector and implications for the global climate system. The outputs used for the model simulation are based on the link between the REMIND model and the MAgPIE model (Model of Agricultural Production and its Impacts on the Environment).

[2] NGFS (Network for Greening the Financial System) is an association of central banks and supervisory bodies with the aim of sharing best practices, contributing to the development of climate and environmental risk management in the financial sector and mobilising core financial resources to support the transition to a sustainable economy.

[3] This is a global econometric model capturing in detail the interconnectedness of all territories in the global economy. For further details on the NiGEM model and its structure, see Hantzsche, Lopresto and Young (2020).

[4] See, for example, Batten et al. (2020), Bylund (2020), Cantelmo (2020), ECB (2021), Economides and Xepapadeas (2018), NGFS (2019b, 2020a).

[5] All the model projections are deduced from a “climate-neutral baseline scenario”, which excludes the physical and transition impacts associated with climate change.