Alignment Analyses 2024 – how is the Czech economy faring in the context of the obligation to join the euro area?

The Czech National Bank has published the Analyses of the Czech Republic’s Current Economic Alignment with the Euro Area (pdf, 2.3 MB), an annual document that presents a long-term view of the Czech economy in the context of the country’s obligation to join the euro area. The document is based on the valid Euro-area Accession Strategy and its 2007 update. The analyses contained assess the Czech Republic’s economic convergence, cyclical and structural alignment with the euro area and the ability of the Czech economy to absorb potential asymmetric shocks after losing its own monetary policy. The analyses focus on a defined range of macroeconomic topics and address some of the institutional issues related to euro area entry. The document does not examine the overall advantages and disadvantages of adopting the euro and does not formulate recommendations on this step. The political decision on setting the target date for euro area entry falls to the government of the Czech Republic.

CZECH REPUBLIC

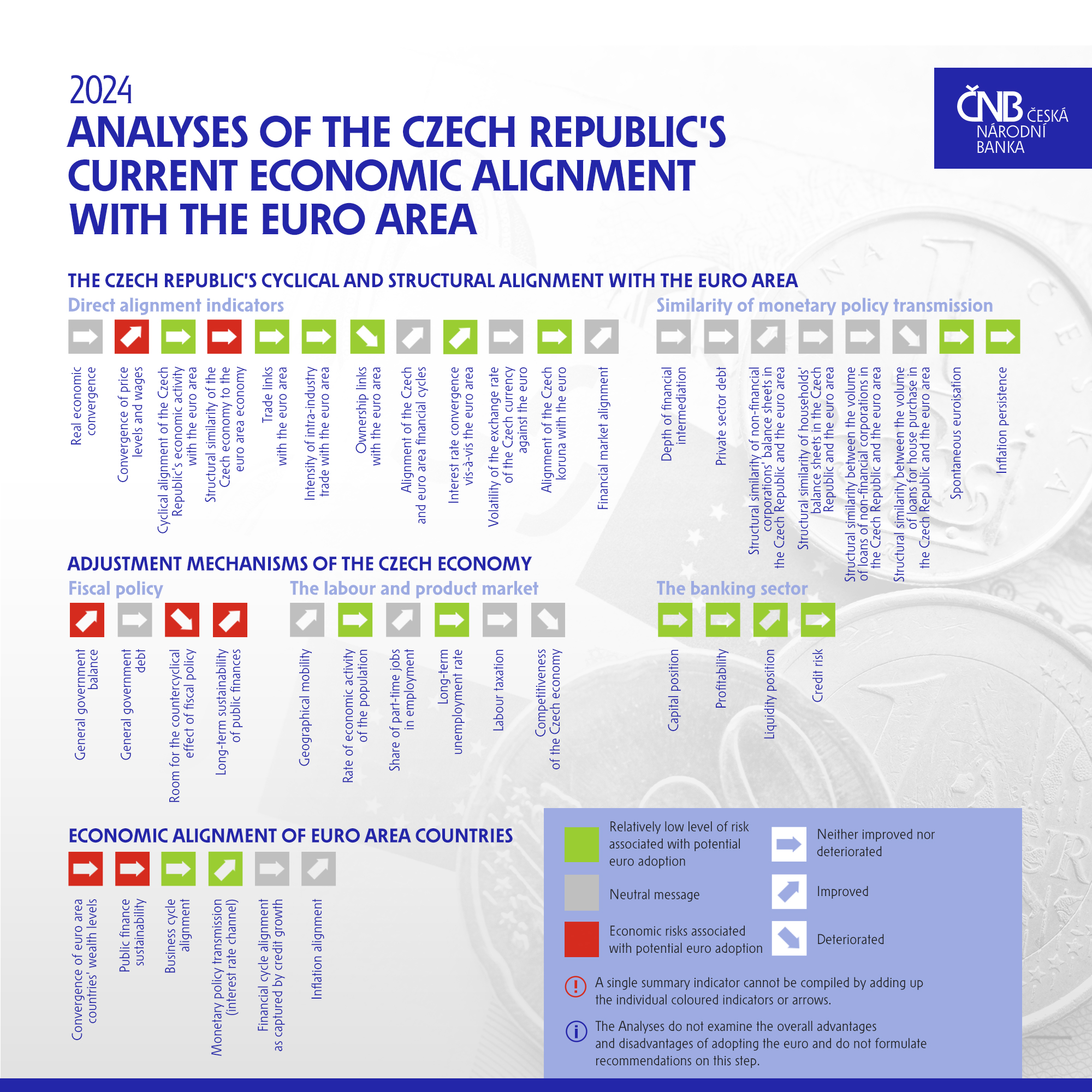

The characteristics of the Czech economy as regards euro area entry can be divided into three groups based on the results of this year’s analyses:

1. Indicators suggesting a relatively low level of risk associated with potential euro adoption in the area analysed

This group has long included the Czech economy’s close trade and ownership links with the euro area, which increase the benefits of euro adoption and foster alignment between the Czech and euro area business cycles. The latter is currently very high, but this may be due to the similar impacts of recent strong global economic shocks and may therefore represent only a temporary phenomenon. Close trade links are also contributing to the high share of euro financing of Czech corporations. The substantial growth seen in previous years halted in 2024 amid a falling interest rate differential between koruna and euro rates. Interest rate spreads between Czech and euro area market rates have returned to near pre-pandemic levels, their decline reflecting the convergence of CNB and ECB monetary policy rates. The Czech koruna remains aligned with the euro vis-à-vis the dollar. Inflation persistence, which in the Czech Republic is not significantly different from that in the euro area, is not an obstacle to euro area entry. As regards the adjustment mechanisms of the Czech economy, the low long-term unemployment rate, which is still among the lowest in Europe, and the high level of economic activity (which does not apply to all groups of the population, however), can be positively assessed. The situation in the domestic banking sector also remains favourable and its resilience to potential negative shocks remains high.

2. Indicators with a neutral message

This category includes an assessment of the alignment of the Czech and euro area financial cycles, which increased slightly last year, and the alignment of the Czech and euro area financial markets, which returned to pre-pandemic levels. Most indicators of monetary policy transmission similarity between the Czech Republic and the euro area are also neutral. The Czech Republic differs from the euro area average in some of the indicators, but this cannot be considered a major barrier to euro adoption. Neither can the condition of the Czech financial system: the depth of financial intermediation and the level of private sector debt in the Czech Republic are relatively low, which means that the economy is less vulnerable to potential shocks from the financial system. As regards the risks associated with potential euro adoption, the assessment of general government debt is also neutral. Despite the continuing public finance deficit, it did not grow in 2023 and remains well below the 60% threshold of the Maastricht convergence criterion. Some labour market indicators can also be considered neutral. These include the share of part-time employment, which remains relatively low despite a slight increase, the geographical mobility of the labour force, and the labour taxation system. The assessment of the competitiveness of the Czech economy has deteriorated slightly but remains solid.

3. Indicators suggesting economic risks associated with potential euro adoption in the area analysed

These indicators include the unfinished process of economic convergence of the Czech Republic towards the euro area, especially as regards the convergence of the price and wage levels. Their lag behind the euro area average remains significant despite faster convergence of the relative level of Czech prices and wages observed over the last two years. The relatively low structural similarity between the Czech economy and the euro area, consisting mainly in an above-average share of industry in domestic GDP, could also be a risk in the event of euro adoption. The structural imbalance of Czech public finances is a persisting problem as regards the adjustment mechanisms of the Czech economy. The general government deficit should fall below the 3% Maastricht criterion in 2024 due to the consolidation package, but it will be desirable to continue reducing the deficit in the years ahead for the future smooth functioning of the Czech Republic within the euro area. Room for the countercyclical effect of fiscal policy is limited by the high share of mandatory expenditures in the state budget and the persistent structural deficits of the government sector mentioned above. Moreover, long-term public finance sustainability remains unresolved, especially in the context of the fiscal implications of population ageing. However, the recently approved pension reform is expected to bring some improvement. As regards labour market flexibility, relatively low female participation in the labour market has long been a problem.

EURO AREA

After a turbulent period marked by the Covid-19, energy, and security crises, macroeconomic developments in the euro area have stabilised. Economic growth in the euro area gradually recovered during 2024. However, the economic performance across euro area countries remains mixed, with many economies – especially those that are industry-oriented – still grappling with stagnating economic activity. Despite subdued economic performance in euro area countries, the labour market has stabilised, with the unemployment rate remaining at historically low levels.

Euro area countries have improved their public finances slightly due to their consolidation efforts, but the situation is still unsatisfactory. The good news is that inflation was brought down to the ECB’s 2% target this autumn, although euro area countries are still facing persistently slow declines in services inflation.

There has been no significant progress this year in the deepening of the economic and monetary union and euro area integration. The negotiations on the related legislative proposals were significantly affected by the end of the institutional cycle and by the personnel changes in the EU institutions following the European Parliament elections in June. There was essentially no strategic discussion in 2024 on the completion and future direction of the banking union, especially as regards risk-sharing, owing to persisting fundamental differences of opinion between the Member States. Partial progress was made in the deepening of the capital markets union.

Conversely, 2024 brought significant changes in the coordination of economic and fiscal policies, with the approval and entry into force of the economic governance review (EGR) package. This package aims to strengthen the sustainability and countercyclical nature of the fiscal policies of euro area and EU Member States and the enforceability of the rules of the Stability and Growth Pact (SGP).

As regards the decision on the timing of the Czech Republic’s potential entry into the euro area, it should be noted that not all of the fundamental obligations that may arise for the Czech Republic from adopting the euro are currently known. This is due to the unfinished nature of some key projects that will significantly affect the functioning of the euro area (such as the banking union) and some persistent issues within the economic and monetary union, including the high debt levels of several Member States. Any decision regarding the timing of joining the monetary union is thus still accompanied by major uncertainties.

INFOGRAPHICS

In preparing the Alignment Analyses, the CNB fulfils its obligation to regularly assess the Czech Republic’s progress in laying the groundwork for euro adoption. The analyses contained in the publication focus on the traditional range of macroeconomic topics without any ambition to assess all issues relevant to the Czech Republic’s entry to the euro area. Using selected indicators, this document aims to provide the public with an overview of the Czech Republic’s alignment with the euro area economy across various sectors, as well as the flexibility of its adjustment mechanisms. Given the broad scope of this issue, these indicators are neither exhaustive nor able to provide a definitive answer on when the Czech economy will be ready to join the euro area. This year’s edition of the Alignment Analyses also covers the ERM II mechanism (including the implications of changes to the entry process, which is a prerequisite for joining the euro area), examines the functioning of the banking union and the potential impacts of the Czech Republic’s entry into that union, and addresses other institutional issues related to euro area accession. A full assessment of the potential benefits and costs arising from these factors – as well as other aspects, such as legal and political considerations related to euro area accession – goes beyond the scope of this document.

Note for journalists:

The “Alignment Analyses” prepared by the CNB are the basis for the report “Assessment of the Fulfilment of the Maastricht Convergence Criteria and the Degree of Economic Alignment of the Czech Republic with the Euro Area”, which is jointly prepared by the Ministry of Finance of the Czech Republic and the CNB. In line with the “Czech Republic’s Euro-area Accession Strategy”, this report assesses progress in laying the groundwork for euro adoption. The updated joint document is to be submitted to the Government of the Czech Republic by the end of March 2025 and will be published once it has been discussed by the Czech government.