CNB keeps mortgage lending rules and countercyclical capital buffer rate unchanged

The Czech financial sector is sound and resilient to potential adverse shocks, according to the conclusions of the Czech National Bank (CNB) Bank Board’s financial stability meeting today. At the meeting, the Bank Board also assessed risks related to mortgage lending and the financial cycle.

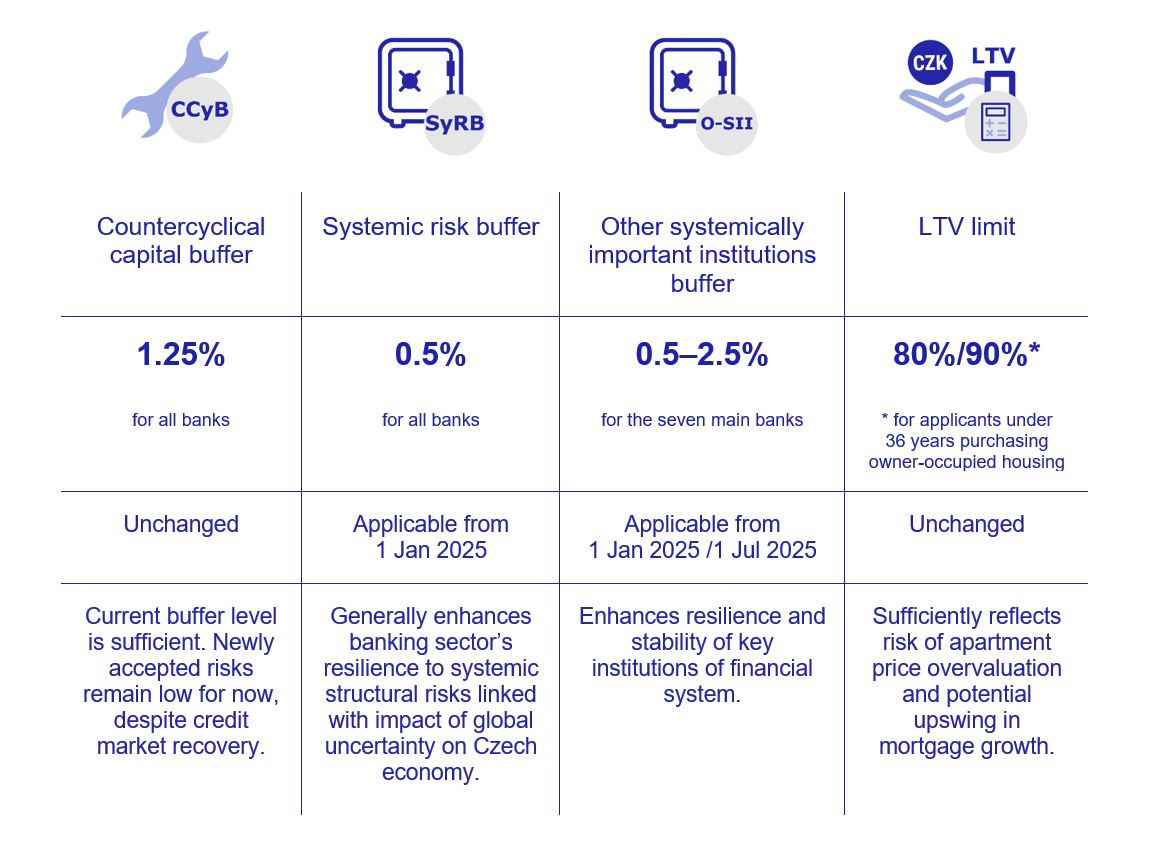

The Czech economy is now at the beginning of a growth phase of the financial cycle. “The mortgage market is gradually picking up and we are also seeing renewed growth in house prices. However, the risk of excessive growth in mortgage loans remains low for now. In this environment, we consider it appropriate to leave the LTV limit unchanged,” said Bank Board member Karina Kubelková following the Bank Board meeting on financial stability issues today. The LTV limit will stay at 80%, or 90% for applicants under 36 years. The DTI and DSTI ratios will remain deactivated.

The Bank Board today also evaluated the situation in the banking sector and decided to leave the countercyclical capital buffer rate at 1.25%. This buffer is intended to increase the banking sector’s resilience to risks associated with the course of the financial cycle. In their decision, the central bankers took into account the extent of cyclical risks in the sector’s balance sheet. The CNB expects these risks to increase gradually over the outlook horizon of its autumn forecast. However, the current buffer level is sufficient to cover this increase. According to Bank Board member Karina Kubelková, if the economy continues to move into the growth phase of the financial cycle, the CNB is ready to increase the buffer rate.

The banking sector is well capitalised and, as a whole, also withstood a stress test focused on risks linked with climate change, including the possible consequences of the transition away from fossil fuels and of potentially higher energy prices. “The banking sector’s starting position for the stress test is favourable. In particular, its profitability and capital buffers help it absorb long-lasting hypothetical shocks impacting on non-financial corporations and households in connection with the climate risks tested,” said Libor Holub, Executive Director of the CNB’s Financial Stability Department.

In the hypothetical Adverse Scenario, the banking sector would comply with the regulatory capital requirements, but the impact on banks’ capitalisation would be significant. A large increase in loan defaults and a long-term deterioration in profitability would necessitate the use of additional capital buffers on top of the countercyclical capital buffer.

In its Financial Stability Report, the CNB regularly assesses the soundness of the domestic financial sector and its resilience to adverse shocks. The report forms the foundation for configuring macroprudential policy tools, in particular banks’ capital buffers and upper limits on mortgage lending ratios. The CNB will publish the current Financial Stability Report – Autumn 2024 on 13 December 2024. The minutes of today’s Bank Board meeting on financial stability issues, including the votes cast by the individual Bank Board members on macroprudential policy measures and also attributed arguments, will be published the same day.

Jakub Holas

Director, Communications Division

Notes for journalists:

Financial stability has been a key objective of the Czech National Bank alongside price stability since 2013. Maintaining financial stability is defined in Act No 6/1993 Coll., on the Czech National Bank. The Act requires the CNB to set macroprudential policy by identifying, monitoring and assessing risks jeopardising the stability of the financial system and, in order to prevent or mitigate these risks, to contribute by means of its powers to the resilience of the financial system and the maintenance of financial stability. Since the second half of 2021, the CNB has had the statutory power to set upper limits on the LTV, DTI and DSTI ratios. Compliance with the limits must be legally binding in order to ensure a level playing field on the market.

The Bank Board discusses financial stability issues twice a year – in the spring in May or June, and in the autumn in November. The aim of this report is to identify the risks to the financial stability of the Czech Republic in the near future on the basis of previous and expected developments in the real economy and the financial system.

The main macroprudential policy tools applied in the Czech Republic are the countercyclical capital buffer (CCyB), the capital conservation buffer (CCoB) set for all banks, the capital buffer for other systemically important institutions (O-SIIs) set for systemically important banks, the systemic risk buffer, the upper limits on the LTV, DTI and DSTI credit ratios set for all mortgage lenders, and the Recommendation on the management of risks associated with the provision of consumer loans secured by residential property.

Countercyclical capital buffer (CCyB) – This instrument is aimed at increasing the resilience of the banking sector to risks associated with fluctuations in lending activity. The CCyB should enable banks to lend to households and firms even at a time of recession or financial instability.

Systemic risk buffer (SyRB) – This buffer is intended to mitigate the potential impacts of systemic risks identified on the financial system and the real economy. If their level poses a risk to financial stability, the application of the SyRB enhances the capitalisation of the banking sector and increases its resilience to adverse shocks. At the same time, it may help reduce the growth or concentration of the relevant exposures in banks’ balance sheets, although this is not its primary purpose.

Capital conservation buffer (CCoB) – This instrument is aimed at preserving a bank’s capital. Under the Act on Banks, all banks are obliged to maintain this buffer. The CCoB rate is 2.5% and does not change over time.

Capital buffer for other systemically important institutions (O-SII) – This instrument is aimed at mitigating risks connected with the potential destabilisation of systemically important institutions, which could have significant adverse effects on the financial system and the economy as a whole. The CNB is required to draw up a list of O-SIIs – and set the buffer for individual O-SIIs where appropriate – at least once a year.

Combined capital buffer – the sum of the capital conservation buffer (CCoB), the countercyclical capital buffer (CCyB), the systemic risk buffer (SyRB) and the capital buffer for other systemically important institutions (O-SII).

LTV (loan-to-value) – the ratio of the value of a mortgage loan to the value of collateral.

DTI (debt-to-income) – the ratio of the applicant’s total debt to their net annual income.

DSTI (debt-service-to-income) – the ratio of the sum of an applicant’s monthly repayments to their net monthly income.