The CNB’s gold

Why does the Czech National Bank need gold? The CNB has one of the largest international reserves portfolios in the world relative to GDP. As a prudent manager, it seeks to manage these reserves as efficiently as possible so that, besides their role in monetary policy, they generate profits and other benefits in the future. In addition, gold is used for the production of commemorative coins and holds symbolic value – by buying gold, the CNB aims to restore its gold reserves.

The advantages of gold

Gold has many advantages beyond its price and symbolic value. CNB analyses have shown that if the central bank holds around 100 tonnes of gold in its international reserves, the volatility of its financial results will decrease. In practice, this means that the bank’s financial results will be less vulnerable to rapid changes or fluctuations in financial markets. The lower volatility of the CNB’s financial results can be achieved due to the specific statistical properties of the price of gold – its low correlation with the prices of other assets – making it an important component of the international reserves portfolio.

The right balance for performance

At the same time, the CNB seeks to increase the return on its international reserves. This can be achieved through better diversification, i.e. by creating the right investment mix. Therefore, the CNB not only buys gold, but also adjusts the size of its equity portfolio as well as its structure (the regional distribution of its equities). The CNB regularly publishes the latest data on the composition of its international reserves on its website.

The CNB as a conservative investor

The CNB is a conservative investor and does not speculate on the price of gold. It buys the precious metal gradually, based on the “averaging effect”. This approach is used by investors to build large portfolios and reduce the risk of poorly timed purchases.

The CNB buys gold on international markets, mostly in London, the leading gold market – specifically the Loco London Precious Metals Market, an over-the-counter market for gold and other precious metals, which ranks among one of the largest and oldest of its kind in the world.

The CNB’s gold purchases are governed by EU Regulation 2017/821, laying down supply chain due diligence obligations.

In December, Bank Board member Karina Kubelková took delivery of one tonne of gold on behalf of the CNB

How does gold make money?

Most of the CNB’s gold reserves are safely stored in London, where they can be easily traded on global markets. The CNB occasionally lends gold, for example, in the form of deposits to other central banks. This generates interest income. Therefore, it cannot be said that owning gold generates no immediate returns. Some of the gold is stored at the CNB’s headquarters in Prague, mostly for the production of CNB gold coins.

The history of the country’s gold reserves

Gold has played both an economic and symbolic role since the establishment of Czechoslovakia in 1918. The story of the country’s gold reserves amid the major historical events of the 20th century is full of interesting twists and turns (in Czech only).

- During the First Republic, gold reserves became an important pillar of our new currency – the Czechoslovak koruna – which needed to gain trust both domestically and internationally. People from across Czechoslovakia were involved in building up the gold reserves through gold donations.

- Before World War II, the country’s gold reserves amounted to 96.6 tonnes. However, the war brought significant losses. The Czechoslovak government estimated these after the war at almost 45.5 tonnes. Only some of the gold was recovered, the largest part not being released to Czechoslovakia until 1982.

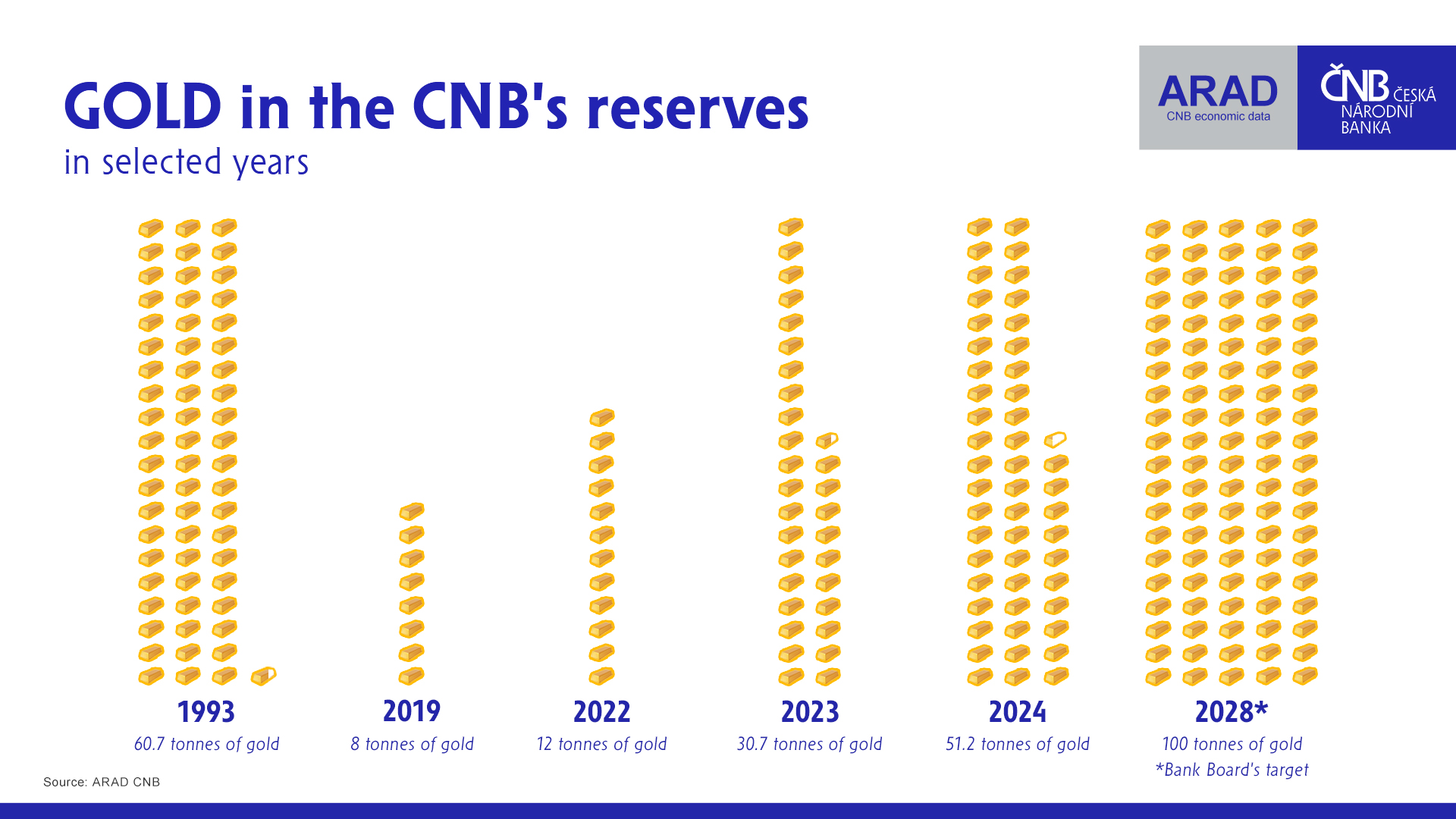

- On the establishment of the independent Czech Republic in January 1993, the CNB held 63.3 tonnes of gold. Following a Bank Board decision to sell the bulk of the gold after 1998, 14 tonnes remained in the CNB’s vaults. In 2019, the central bank held just 8 tonnes, the lowest amount in its history.

Restoration of the country’s gold reserves

The CNB has been buying gold again since 2023, gradually rebuilding the nation’s gold reserves. It currently holds over 50 tonnes of this precious metal. By 2028, its international reserves will include 100 tonnes of gold – the most in its history.

Gold bars or bricks?

Gold bars are typically cast in open moulds. The colloquial term “brick” comes from their two predominant shapes: a rectangular cuboid with rounded edges and/or corners and a four-sided truncated pyramid with a rectangular base.

What information can be found on them?

Central bank gold reserves usually consist of “standardised bars”, the most notable being Good Delivery Bars conforming to the Good Delivery standards set by the London Bullion Market Association (LBMA). These standards specify the exact parameters for the bars – such as weight, dimensions, fineness and markings – and define which bars are recognised as tradeable (deliverable) on the London market, i.e. on the aforementioned Loco London Precious Metals Market.

These bars have a minimum fineness of 995 parts per thousand and a weight of 350–430 troy ounces (about 10.9–13.4 kg), most often 400 troy ounces (about 12.4 kg). Each is marked with the bar number, the fineness, the year of manufacture and the refiner’s stamp. The most significant refiners are included on the LBMA’s Good Delivery List. There are only a few dozen of these internationally recognised refiners worldwide.

For commercial and investment purposes, smaller bars – either cast or minted – are produced for other entities, including private individuals, with weights as low as 1 gram or in other, regional units (such as baht, chi, don, mesghal, tael and tola).

How does gold sound?

Listen to the sound of the gold stored in the CNB vault.

Karina Kubelková: We buy gold regularly

In a special report by Czech Television, Bank Board member Karina Kubelková presented part of the gold reserves stored in the CNB’s high security vault in Prague. The CNB buys gold on a regular basis. It will have 100 tonnes of this precious metal in its international reserves by the end of 2028.