- About the CNB

About the CNB

The CNB is the central bank of the Czech Republic, the supervisor of the Czech financial market and the Czech resolution authority. It is established under the Constitution of the Czech Republic and carries out its activities in compliance with Act No. 6/1993 Coll., on the Czech National Bank, as amended.

- Monetary policy

Monetary policy

The Czech National Bank endeavours to keep inflation low, stable and therefore predictable. It achieves its inflation target of 2% by setting interest rates and other monetary policy instruments. The Bank Board decides about them on the basis of a macroeconomic forecast and an assessment of its risks and uncertainties.

- Financial stability

Financial stability

The CNB sets macroprudential policy by identifying, monitoring and assessing risks to the stability of the financial system and, in order to prevent or mitigate these risks, contributes by means of its powers to the resilience of the financial system and the maintenance of financial stability.

- Supervision, regulation

Supervision, regulation

The CNB is the supervisory authority for the financial market in the Czech Republic. It lays down rules safeguarding the stability of the banking sector, the capital market, the insurance industry and the pension scheme industry. It regulates, supervises and, where appropriate, issues penalties for non-compliance with these rules.

- The Supervisory Strategy of the Czech National Bank

- What’s new in supervision

- Legislation

- Conduct of supervision

- Lists and registers

- Aggregate information on the financial sector

- Information published by issuers

- Information on Short Positions

- Central Credit Register

- Financial innovation

- Consumer protection and financial literacy

- Banknotes and coins

Banknotes and coins

The CNB is the exclusive issuer of Czech banknotes and coins. Circulating banknotes and coins are intended for cash payments. Commemorative banknotes and coins are intended for collection and investment purposes and the CNB sells them through its contractual partners at prices different from their nominal values.

- Payments

Payments

The CNB contributes to preparing draft legislation in the area of payments and clearing between banks, foreign bank branches and credit unions. It promotes smooth and efficient payments and contributes to the safety, soundness, efficiency and development of payment systems.

- Financial markets

Financial markets

The CNB declares the exchange rate of the Czech koruna against other currencies in the form of foreign exchange market rates and in the form of exchange rates of other currencies. This section contains information about the foreign exchange market, the money market and the Treasury securities market, including regulations relating to the financial market in the Czech Republic.

- Resolution

Resolution

The CNB is the resolution authority for banks, credit unions and certain investment firms in the Czech Republic. Resolution means the restructuring of an institution to ensure the continuity of its critical functions, minimise the impacts on the economy and the financial system and restore the viability of all or part of that institution.

- Statistics

Statistics

The CNB in its area of competence compiles and publishes statistics, in particular monetary and financial statistics, balance of payments statistics, supervisory statistics, financial accounts statistics, general economic statistics and government finance statistics. The statistics are compiled in accordance with international standards and the standards of the European Union and the relevant requirements of the European supervisory authorities.

- ARAD – time series system

- Monetary and financial statistics

- AnaCredit

- Balance of payments statistics

- Supervisory statistics

- Financial accounts statistics

- General economic statistics

- Government finance statistics

- Inflation

- SDDS Plus

- Data publishing schedule

- Regulations

- Reporting and data collection

- Other CNB statistics

- Bank Lending Survey

- Research

Research

The objective of the CNB‘s research is to provide outputs which help to expand the knowledge base needed for the core activities of the CNB and which are of a high standard on the international scale. The coordination and implementation of research is carried out by the Research Division, which is part of the Research and Statistics Department.

- About the CNB

- Monetary policy

- Financial stability

- Supervision, regulation

- The Supervisory Strategy of the Czech National Bank

- What’s new in supervision

- Legislation

- Banks and credit unions

- Insurance and reinsurance companies and insurance intermediaries

- Pension management companies and funds, pension intermediaries

- Investment firms and investment intermediaries

- Management Companies and Investment Funds

- Payment institutions,electronic money institutions, small-scale payment service providers and small-scale electronic issuers

- Financial conglomerates

- Trading venues, settlement, registration of securities and regulated market protection

- Issuance, takeover bids and squeeze-outs

- Bureaux de change

- Money laundering

- OTC derivatives and securitisation

- Other (auditing, rating agencies, indices)

- Recovery and resolution

- Consumer protection and consumer credit

- Non-performing credit servicing

- Key Information Documents (PRIIPs)

- Sustainable finance

- Pan-European Personal Pension Product (PEPP)

- Digital operational resilience

- Conduct of supervision

- Public notices

- Status of supervision

- Licensing and approval proceedings conducted by the Czech National Bank

- Final administrative decisions of the Czech National Bank

- Information duties of financial market entities vis-à-vis the Czech National Bank

- Takeover bids and tender offers

- International activities

- Memoranda of understanding

- Supervisory disclosure pursuant to EU directive

- Supervisory official information and benchmarks

- Lists and registers

- Aggregate information on the financial sector

- Information published by issuers

- Information on Short Positions

- Central Credit Register

- Financial innovation

- Consumer protection and financial literacy

- Banknotes and coins

- Payments

- Financial markets

- Resolution

- Statistics

- ARAD – time series system

- Monetary and financial statistics

- AnaCredit

- Balance of payments statistics

- Supervisory statistics

- Financial accounts statistics

- General economic statistics

- Government finance statistics

- Inflation

- SDDS Plus

- Data publishing schedule

- Regulations

- Reporting and data collection

- Other CNB statistics

- Bank Lending Survey

- Research

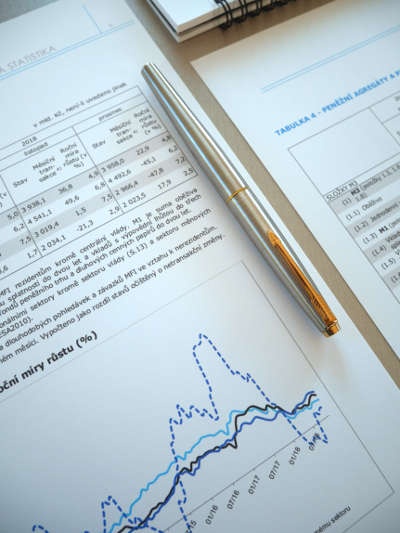

Inflation comes in slightly above the CNB’s 2% target in July 2024

The CNB comments on the July 2024 inflation figures

According to figures released today, the price level increased by 2.2% year on year in July 2024. Annual consumer price inflation accelerated by 0.2 percentage point compared to the previous month but remains very close to the CNB’s 2% target.

Annual inflation was 0.2 percentage point higher in July than the CNB’s summer forecast. This was due to stronger growth in administered prices and a lower-than-expected decline in prices of food, beverages and tobacco. Core inflation was also slightly higher than expected. Its month-on-month growth reflected a stronger seasonal increase in prices of package holidays. By contrast, fuel prices rose exactly in line with the forecast.

A stabilisation of core inflation is being fostered not only by weak growth in the prices of foreign inputs, but also the previous protracted downturn in domestic demand due in part to tight CNB monetary policy. This is fostering a decrease in the profit mark-ups of producers, retailers and service providers over their costs. These factors moderating market services inflation are thus offsetting the buoyant wage growth. Goods prices within core inflation are rising only marginally year on year. The growth in imputed rent accelerated slightly and is beginning to gradually reflect the current recovery on the property market.

Food prices continued to show an only modest year-on-year decline due to the previous decrease in global agricultural commodity prices and domestic agricultural producer prices. Fuel prices are rising much more slowly than in the spring months. In month-on-month terms, however, they increased slightly due to the depreciation of the koruna in July. Annual administered price inflation continued to slow in July owing to a gradual decrease in energy prices for households.

In month-on-month terms, the price level increased by 0.7% in July. This was due mainly to an increase in package holiday prices, which had lagged significantly behind their usual seasonal pattern in June, partly offsetting this in July. According to the CNB’s summer forecast, inflation will be close to the 2% target for the rest of this year.

Jakub Matějů, Deputy Executive Director, Monetary Department