Aleš Michl, CNB Governor

Senate of the Parliament of the Czech Republic

Prague, 25 July 2024

On the occasion of the discussion of Financial Market Supervision Report 2023, CNB Governor Aleš Michl delivered a speech in the Senate of the Parliament of the Czech Republic on the current fight against inflation, the course of the liquidation of Sberbank and the financial performance of the Czech National Bank.

Dear Chairman, esteemed senators,

The new Bank Board assumed responsibility for monetary policy and price and financial stability in our country in July 2022.

Things weren’t good:

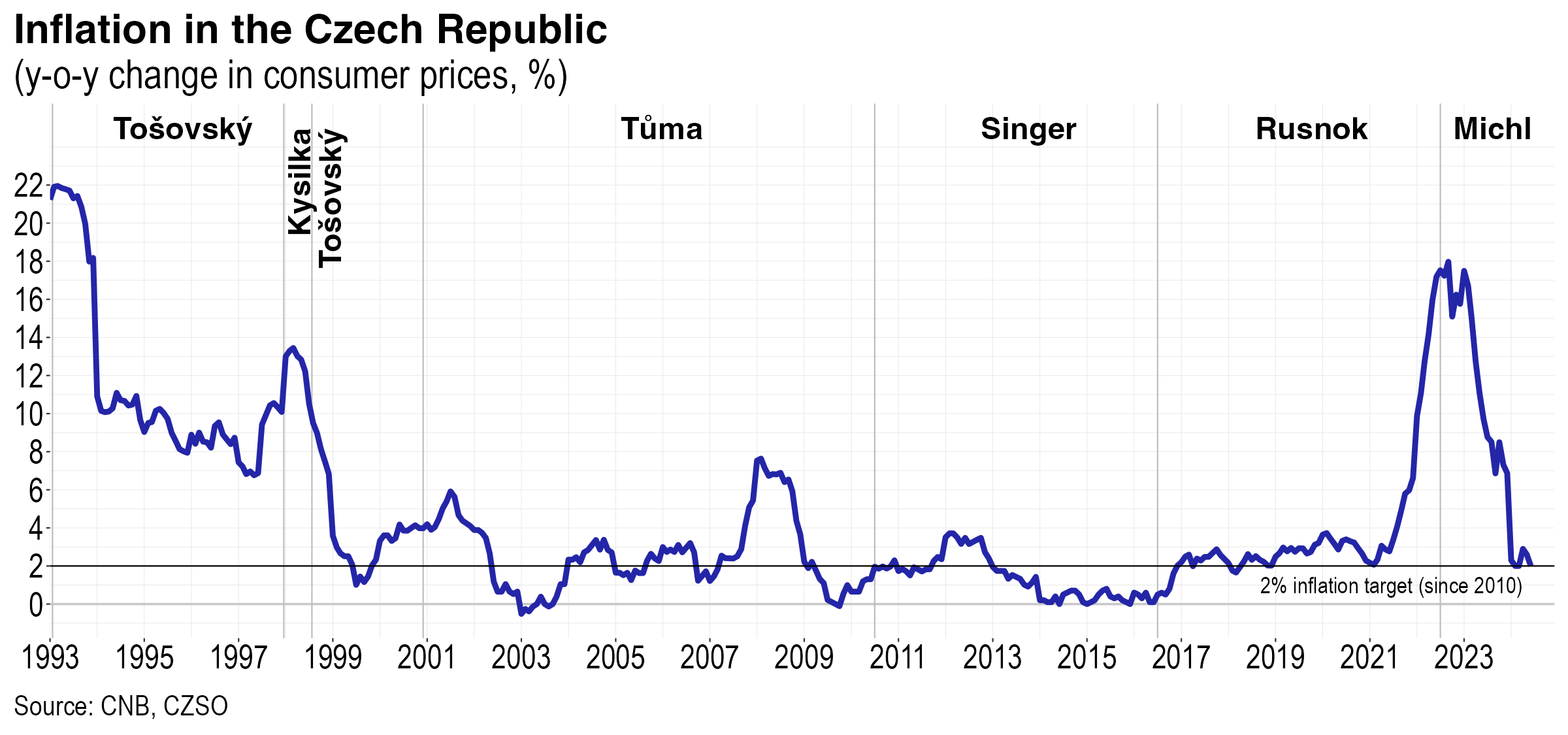

- First, we had the highest inflation in our history (17.5%), leaving aside the transformation period of the early 1990s. The Czech National Bank was far from achieving its statutory primary objective of price stability.

- Second, the liquidation of Sberbank was engulfed in litigation challenging the entire process – litigation by the state, filed by representatives of the Ministry of Finance, regions and municipalities, which had entrusted Sberbank with their money. An important task for us as regards financial stability and credibility was to ensure that the process of liquidating the bank was transparent, as the CNB – a member of the Sberbank creditors’ committee – is responsible by law for ensuring financial stability and seeing to the sound operation of the financial system in the Czech Republic.

- Third, we took over the CNB at a time when it had posted its biggest ever loss, amid record-high growth in operating expenses.

It was vital for us to tackle the situation head-on and deliver results as quickly as possible.

As regards the first issue – high inflation – in a speech I gave at Masaryk University in November 2022 I unveiled a new monetary strategy setting out the conditions under which the Czech koruna would be strong again (Michl, 2022). In spring 2023, we achieved the tightest monetary conditions (the combined effect of interest rates and the exchange rate on the economy) in 20 years. The exchange rate of the koruna was the strongest ever at the time, so the country was able to import expensive commodities more cheaply. The strong koruna also tightened monetary conditions for large firms, which until then had not been affected by the CNB’s high rates, since they were borrowing in euros. Although the nominal rate stayed at 7% for most of 2023, ex ante real interest rates – which reflect expected inflation – gradually rose to historical highs. Only then did monetary policy start to work the most.

The new monetary strategy had the desired effect.

Inflation is currently at 2%, i.e. exactly where I promised it would be when I was appointed governor two years ago. I thank everyone at the CNB for helping me keep my promise – it is a success of the entire Czech National Bank.

There was no celebration, news conference or the like, because the future will judge us not by partial successes but by the long-term results of our work.

We will stay hawkish and do our utmost to achieve price stability. For example, over the ten years to 2022, the average policy rate in our country was 1%. Moreover, the koruna was intentionally devalued. All that supported inflation – this was the first of two crucial mistakes made in the past. No wonder the previous governor ended his mandate with the highest inflation in history. We must change this above all else. We expect rates to be higher than we have been used to over the last ten years or more. We must think about the future. The economy needs to be based on savings, not debt. I discussed this in more detail in my speech in London (Michl, 2024).

As for the second issue, the liquidation of Sberbank became the most successful bank insolvency case in our history, thanks in no small part to the work of our people at the CNB as member of the creditors’ committee. Just to remind you, many entities had taken legal action against the whole process, but we managed to convince them that we were steering the right course. We held many negotiations, attended many meetings and made many decisions during 2023. By the start of 2024, 95% of the money of Sberbank’s customers had been repaid. The work will continue until the remaining minority of the money has been returned and the liquidation process has been successfully completed – although there is still some way to go. More details are available in our annual Financial Market Supervision Report (pdf, 1.5 MB, in Czech only).

Turning to the third problem – the central bank’s finances – the current Bank Board inherited the bank’s largest ever cumulative loss: CZK 487 billion. We immediately began to address operations, one of the parts of the profit and loss account that was not in good order. We had to tame the record rise in our operating expenses, as the CNB should set an example for the public.

We therefore started a rationalisation process at the CNB. Alois Rašín would have been pleased with the results: during 2023 we downsized our senior management team – managers reporting directly to the Bank Board (BR−1s) – from 17 to 14. As well as delivering cost savings, this made the institution more manageable. There are now 14 BR−1s under the seven board members, meaning that each member oversees two teams. The board members can thus give the teams their full attention and deliver results together. In particular, the integration of the licensing and enforcement teams into the supervision function should greatly improve the results of our work.

We also rationalised every department at the bank. The number of job positions at the CNB was reduced by 5.1% in 2023. This was the first time the central bank’s operations had been comprehensively streamlined in ten years.

Results of the rationalisation at the CNB

| 2022 | 2023 | Annual change in % | |

|---|---|---|---|

| Number of Job Positions | 1,516 | 1,439 | -5.1 |

| Number of Board – 1 Executives | 17 | 14 | -17.6 |

Source: CNB

Wage restraint at the CNB in 2023

(annual change in %)

| Inflation | 10.7 |

| Growth in Board members’ salaries | 0 |

| Growth in salaries of executive directors reporting to the Board | 0 |

| Average wage growth | 4.5 |

Source: CNB

The CNB ended 2023 with a profit of CZK 55.1 billion. We therefore erased part of our accumulated loss of previous years in 2023. However, our asset and liability structure is not yet such as to allow us to generate a profit on a sustained basis, and we need to continue to make changes.

We must remedy the other mistake made in the past: the CNB’s balance sheet increased substantially on the back of the CNB’s previous koruna devaluation policy. However, the expected return on our assets did not cover the expected cost of our liabilities – hence the inherited record-high loss of the CNB.

In particular, we are going to diversify our assets and increase the expected return on them. This process should be aided by the gradual purchase of gold up to a total of 100 tonnes, which would be the largest amount in the CNB’s history (for comparison, in 2019 we had 8 tonnes of gold in our vaults, an all-time low). Therefore, we will have a gold reserve again.

We are also going to gradually increase the share of equities. If you are interested in this issue, I recommend you read the findings of the research I conducted with my colleagues Tomáš Adam and Michal Škoda (Adam, Škoda, Michl, 2023). I will do all I can to leave the next governor a better balance sheet and profit and loss account than I inherited.

What counts is delivering results and thinking about the future, that is, what we at the Bank can do for our country and leave for future generations.

References:

Adam, T., Škoda, M., & Michl, A. (2023). Balancing Volatility and Returns in the Czech National Bank’s Foreign Exchange Portfolio (RPN 1/2023). Czech National Bank.

Michl, A. (2022). Policy for a Strong Koruna. CNB Discussion Forum. Faculty of Economics and Administration at Masaryk University, Brno. 23 November 2022.

Michl, A. (2024). Taming Inflation from 18 to 2% and Paving the Way for ESG Financing. Central Banking Summer Meetings, London. 13 June 2024.